Businesses must prioritize security while ensuring a seamless customer experience in today’s rapidly digitalizing world.

One key element in achieving this balance is Know Your Customer (KYC) processes. KYC plays a critical role in identity verification, ensuring that businesses can confidently interact with their clients while mitigating fraud and risk.

Banks that automated 20% of their KYC process saw a triple benefit effect. It includes:

- Quality-assurance scores went up by 13% on an absolute basis

- Better customer experience by reducing customer outreaches by 18%

- Enhanced productivity by processing 48% more cases per month

However, traditional KYC methods are often time-consuming and cumbersome, leading to the rise of automated KYC verification.

This blog post will explore the ins and outs of automated KYC verification, its benefits, and its impact on businesses.

What Is Automated KYC Verification?

Automated KYC verification uses technology to simplify the process of verifying customer identities, replacing manual efforts with efficient solutions.

By using AI and machine learning algorithms, these systems can quickly analyze and verify customer information, ensuring accuracy and compliance with regulations.

The main technologies behind automated KYC verification include advanced data analytics, biometric authentication, and real-time data validation.

AI and machine learning are crucial for improving these technologies, allowing them to adapt with each interaction.

This ability to adapt helps automated KYC systems stay current with changing regulations and emerging threats, ensuring strong security and compliance.

Manual vs. Automated KYC Verification

Manual KYC checks involve employees carefully examining documents and data, which can take a lot of time and may lead to mistakes.

On the other hand, automated KYC uses technology to handle these tasks quickly and accurately with less human involvement.

This automation speeds up the process of bringing new customers on board and reduces errors, enhancing the customer experience by providing faster access to services without sacrificing security.

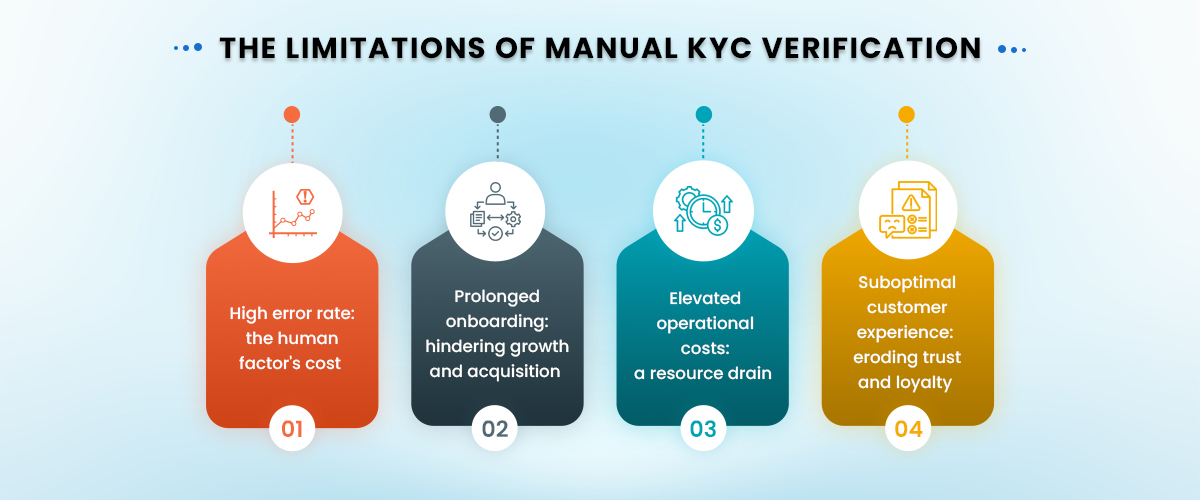

The Limitations of Manual KYC Verification

Manual KYC processes are how financial institutions and banks check their customers’ identities. These processes often take longer, are more expensive, and are prone to mistakes. Managing these manual checks is a tiresome task. Here are some of the challenges:

1. High Error Rate: The Human Factor’s Cost

Manual KYC is inherently error-prone. Subjective interpretations, varied staff training, and simple human fatigue lead to misidentification and acceptance of fraudulent accounts. This results in financial losses, regulatory penalties, and reputational damage. Correcting these errors further drains resources, creating a cycle of inefficiency that undermines security and compliance.

2. Prolonged Onboarding: Hindering Growth and Acquisition

Manual verification drastically slows customer onboarding, a critical flaw in today’s fast-paced digital world. Lengthy processes deter potential customers seeking instant access, leading to lost acquisition and competitive disadvantage. This delay impedes new product launches and overall growth, as customers quickly turn to faster, more streamlined alternatives.

3. Elevated Operational Costs: A Resource Drain

Manual KYC’s labor-intensive nature drives up operational expenses. Staffing, document storage, and compliance costs all increase. Correcting manual errors further strains budgets, particularly for smaller institutions. This financial burden hinders profitability and limits investment in innovation, making manual processes a costly liability.

4. Suboptimal Customer Experience: Eroding Trust and Loyalty

Customers find manual KYC intrusive and frustrating. Repeated document submissions and lengthy waits damage trust and loyalty. In a digital-first world, this leads to customer churn and negative reviews. A poor onboarding experience creates dissatisfaction, undermining long-term customer relationships and brand perception.

How Does Automated KYC Verification Work?

Automated KYC verification involves several key steps that streamline the identity verification process.

First, customers provide their identification documents, such as passports or driver’s licenses, which are then scanned and analyzed by the system.

The software cross-references the information with various databases, checking for consistency and validity.

Next, the system employs biometric authentication techniques, such as facial recognition or fingerprint scanning, to verify the customer’s identity.

This step adds an additional layer of security, ensuring that the person presenting the documents is indeed the rightful owner.

Finally, the AI-driven system conducts a risk assessment, evaluating factors such as transaction history and geographic location to determine the likelihood of fraudulent activity.

This comprehensive approach ensures that businesses can confidently onboard new customers while reducing risk and maintaining regulatory compliance.

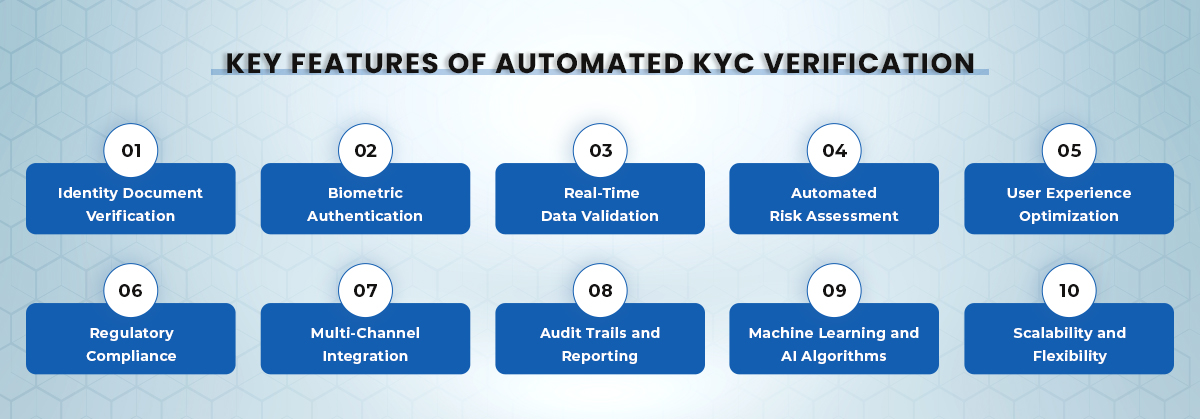

Key Features of Automated KYC Verification

Automated KYC verification is designed to transform the way businesses verify identities, offering a seamless blend of security, compliance, and user experience.

These key features empower businesses to streamline processes, enhance security measures, and maintain regulatory compliance while delivering a superior customer experience:

1. Identity Document Verification

Automated KYC systems analyze identification documents for authenticity, cross-referencing data with relevant databases to verify accuracy and consistency.

This feature ensures that businesses can confidently trust the information provided by their customers.

2. Biometric Authentication

Biometric authentication adds an extra layer of security by verifying a customer’s physical characteristics, such as facial features or fingerprints.

This method ensures that the person presenting the documents is indeed the individual they claim to be, reducing the risk of identity fraud.

3. Real-Time Data Validation

Real-time data validation allows automated KYC systems to quickly assess the accuracy and consistency of customer information.

By cross-referencing multiple data sources, these systems can identify discrepancies and ensure that businesses receive accurate and up-to-date information.

4. Automated Risk Assessment

Automated risk assessment evaluates customer information to determine the likelihood of fraudulent activity.

By analyzing factors such as transaction history and geographic location, automated KYC systems can identify potential risks and help businesses make informed decisions.

5. User Experience Optimization

Automated KYC solutions prioritize user experience, ensuring that customers can quickly and easily complete the verification process.

By streamlining onboarding and minimizing delays, these systems enhance customer satisfaction and foster long-term loyalty.

6. Regulatory Compliance

Automated KYC verification systems help businesses maintain compliance with evolving regulations by continuously updating their processes and adapting to new requirements.

This ensures that businesses can confidently meet regulatory standards while minimizing the risk of penalties or fines.

7. Multi-Channel Integration

Automated KYC solutions offer multi-channel integration, allowing businesses to verify customer identities across various platforms and devices.

This flexibility ensures that businesses can cater to diverse customer needs and preferences, enhancing the overall user experience.

8. Audit Trails and Reporting

Comprehensive audit trails and reporting capabilities enable businesses to track and document the KYC verification process.

This transparency ensures that businesses can demonstrate compliance with regulatory requirements and swiftly address any discrepancies or issues.

9. Machine Learning and AI Algorithms

Machine learning and AI algorithms enhance the capabilities of automated KYC systems, allowing them to adapt and improve over time.

These technologies enable systems to identify patterns and trends, ensuring that businesses remain protected against emerging threats and evolving regulatory requirements.

10. Scalability and Flexibility

Automated KYC solutions offer scalability and flexibility, allowing businesses to adapt to changing customer needs and business environments.

This adaptability ensures that businesses can continue to provide efficient and secure identity verification as their operations grow and evolve.

Benefits of Automated KYC Verification

Let’s explore the transformative benefits that automated KYC verification brings to the table:

1. Increased Efficiency

Automated KYC verification streamlines the identity verification process, significantly reducing the time it takes to onboard new customers.

This increased efficiency allows businesses to serve more clients without compromising accuracy or security.

2. Cost Reduction

By automating the KYC process, businesses can reduce labor costs associated with manual verification efforts.

Additionally, automated systems minimize the likelihood of costly errors and inconsistencies, further contributing to cost savings.

3. Enhanced Customer Experience

Automated KYC solutions prioritize user experience, ensuring that customers can quickly and easily complete the verification process.

This focus on customer satisfaction fosters long-term loyalty and encourages repeat business.

4. Improved Accuracy

AI-driven automated KYC systems process large volumes of data quickly and accurately, minimizing the risk of errors and inconsistencies.

This improved accuracy ensures that businesses can confidently trust the information provided by their customers.

5. Faster Onboarding

Automated KYC verification significantly reduces the time it takes to onboard new customers, allowing businesses to serve more clients in less time.

This streamlined onboarding process enhances customer satisfaction and drives business growth.

6. Scalability

Automated KYC solutions offer scalability, allowing businesses to adapt to changing customer needs and business environments.

This adaptability ensures that businesses can continue to provide efficient and secure identity verification as their operations grow and evolve.

7. Real-Time Monitoring

Real-time monitoring capabilities enable businesses to track customer interactions and transactions, identifying potential risks and ensuring compliance with regulatory requirements.

This proactive approach helps businesses maintain security and mitigate potential threats.

8. Regulatory Compliance

Automated KYC systems continuously update their processes and adapt to new regulatory requirements, ensuring that businesses can confidently meet compliance standards.

This proactive approach minimizes the risk of penalties or fines and protects businesses from reputational damage.

9. Risk Mitigation

Automated KYC verification systems employ advanced risk assessment techniques to identify potential threats and vulnerabilities.

By proactively addressing these risks, businesses can safeguard their operations and protect their customers.

10. Data Security

Automated KYC solutions prioritize data security, employing encryption and other protective measures to safeguard customer information.

This focus on security ensures that businesses can maintain customer trust and protect sensitive data.

Comparison of 7 Leading Automated KYC Providers

In the fast-evolving world of digital identity verification, selecting the right KYC provider is crucial for businesses aiming to enhance security and streamline onboarding processes.

Here, we compare seven leading automated KYC providers:

1. FTx Identity

FTx Identity sets itself apart with a comprehensive suite of advanced verification tools that transform the identity verification process while remaining cost-effective.

Its design prioritizes scalability and flexibility, making it an ideal choice for businesses of various sizes and industries.

FTx Identity offers exceptional value for money, ensuring businesses can stay secure without compromising their budget.

2. Onfido

Onfido specializes in AI-driven identity verification, providing businesses with robust solutions for verifying customer identities.

Its platform supports a wide range of identification documents and biometric authentication techniques, ensuring accuracy and compliance.

3. Jumio

Jumio offers a flexible and scalable automated KYC solution that leverages AI and machine learning to verify customer identities.

With a focus on user experience and regulatory compliance, Jumio ensures seamless onboarding and secure transactions.

4. Trulioo

Trulioo provides a powerful KYC verification platform that integrates seamlessly with existing systems.

Its advanced risk assessment capabilities and real-time monitoring ensure robust security and compliance with regulatory requirements.

5. IDnow

IDnow offers a comprehensive suite of automated KYC verification tools designed to streamline the identity verification process.

With a focus on scalability and flexibility, IDnow caters to businesses of all sizes and industries.

6. Sumsub

Sumsub specializes in AI-driven identity verification, providing businesses with robust solutions for verifying customer identities.

Its platform supports a wide range of identification documents and biometric authentication techniques, ensuring accuracy and compliance.

7. Veriff

Veriff offers a flexible and scalable automated KYC solution that leverages AI and machine learning to verify customer identities.

With a focus on user experience and regulatory compliance, Veriff ensures seamless onboarding and secure transactions.

Implementing Automated KYC Verification

Implementing automated KYC verification requires a strategic approach to unlock its full potential, ensuring seamless integration and enhanced security.

By following a well-structured plan, businesses can achieve greater efficiency and compliance, setting the foundation for sustainable growth.

1. Assess Business Requirements

Before implementing an automated KYC solution, businesses must assess their specific needs and requirements.

This evaluation helps determine the most suitable solution and ensures seamless integration with existing systems.

2. Choose the Right Automated KYC Solution

Selecting the right automated KYC solution is crucial for achieving desired outcomes.

Businesses should consider factors such as scalability, flexibility, and regulatory compliance when evaluating potential providers.

3. Integrate with Existing Systems

Seamless integration with existing systems is essential for successful implementation.

Businesses should work closely with their chosen provider to ensure a smooth transition and minimal disruption to operations.

4. Customize Workflows

Customizing workflows to align with specific business needs and processes is key to maximizing the benefits of automated KYC verification.

Tailored solutions ensure that businesses can optimize efficiency and maintain compliance with regulatory requirements.

5. Establish Data Security Protocols

Implementing robust data security protocols is critical for protecting sensitive customer information.

Businesses should work with their chosen provider to establish and maintain encryption and other protective measures.

6. Train Staff on New Processes

Comprehensive staff training is essential for ensuring a smooth transition to automated KYC verification.

Employees should be familiar with new processes and tools to ensure optimal efficiency and accuracy.

7. Test the KYC Solution

Thorough testing of the automated KYC solution is crucial for identifying and addressing any potential issues before full implementation.

This step ensures that businesses can confidently rely on their chosen system.

8. Launch the Automated KYC System

Once testing is complete and any necessary adjustments have been made, businesses can proceed with launching their automated KYC system.

This stage marks the beginning of a more efficient and secure identity verification process.

9. Monitor Performance and Compliance

Ongoing monitoring of system performance and compliance is essential for maintaining optimal efficiency and security.

Businesses should regularly review their automated KYC processes to ensure continued success.

10. Gather Feedback and Optimize

Collecting feedback from customers and employees is crucial for identifying areas for improvement and optimization.

Businesses should use this information to refine their automated KYC processes and enhance overall performance.

Use Cases of Automated KYC Verification

Following are the use cases of automated KYC verification:

1. Customer Onboarding

Automated KYC significantly accelerates the account opening process. By instantly verifying identity, new customers can be brought onboard rapidly. This streamlined approach minimizes friction and enhances the customer experience, leading to increased customer satisfaction and faster revenue generation for the institution.

- Rapid identity verification: Automated systems use facial recognition, document scanning, and database checks to verify identities in real-time, eliminating manual reviews.

- Reduced onboarding time: Customers can complete the process in minutes, rather than days or weeks, improving their initial experience.

- Improved customer satisfaction: A seamless, digital onboarding process reduces frustration and builds trust, leading to higher customer retention.

2. Transaction Monitoring

Real-time monitoring of transactions is crucial for detecting and preventing financial crimes. Automated systems can continuously analyze transactions, flagging suspicious activities that may indicate fraud or money laundering. This proactive approach helps mitigate risks and protect the institution from financial losses and regulatory penalties.

- Real-time detection of suspicious activity: Automated algorithms analyze transaction patterns and flag anomalies that may indicate fraud or money laundering, enabling immediate intervention.

- Flagging of potentially fraudulent transactions: The system identifies unusual transaction sizes, locations, or frequencies, triggering alerts for further investigation.

- Prevention of money laundering: Automated systems screen transactions against sanctions lists and watchlists, ensuring compliance with AML regulations and preventing illicit funds from entering the financial system.

3. Customer Due Diligence (CDD)

Automated CDD processes streamline the verification of customer identities against official databases. This ensures accuracy and compliance with regulatory requirements. Automated tools assess customer risk profiles based on various factors, simplifying the compliance process and reducing the risk of non-compliance penalties.

- Automated verification against official databases: Digital systems access and verify customer information against government databases, credit bureaus, and other reliable sources.

- Risk assessment based on various factors: Automated tools analyze customer data, including location, transaction history, and business type, to assess risk levels and assign appropriate risk scores.

- Simplified adherence to regulatory requirements: Automated processes generate audit trails and compliance reports, making it easier to demonstrate compliance and pass regulatory audits.

4. Enhanced Due Diligence (EDD)

For high-risk customers, such as politically exposed persons (PEPs), automated EDD tools conduct in-depth investigations. This involves gathering data from multiple sources to provide a comprehensive view of customer risk, ensuring thorough risk management, and mitigating potential legal and reputational risks.

- In-depth investigations for high-risk customers: Automated systems conduct enhanced background checks, including screening against watchlists, adverse media searches, and beneficial ownership analysis.

- Data aggregation from multiple sources: The system gathers data from public records, news articles, social media, and other sources to create a comprehensive customer profile.

- Efficient risk management: Automated EDD processes enable faster and more thorough risk assessments, reducing the risk of regulatory penalties and financial losses.

5. AML Screening

Automated AML screening involves checking customers against global sanctions lists and PEP databases. This ensures ongoing compliance with anti-money laundering regulations and helps prevent dealings with sanctioned individuals. Continuous monitoring is essential to detect changes in sanctions and PEP status.

- Screening against global sanctions lists: Automated systems continuously screen customers against lists from OFAC, UN, EU, and other regulatory bodies.

- Screening against PEP databases: The system identifies individuals who are politically exposed and require enhanced due diligence to mitigate corruption risks.

- Continuous monitoring for AML compliance: Automated systems monitor customer activity and update screening results in real-time, ensuring ongoing compliance with AML regulations.

6. Data Enrichment

Automated systems can pull data from various sources to enrich customer profiles. This ensures that customer information is accurate and up-to-date, providing a more comprehensive view of customer risk. Enhanced data improves the quality of risk evaluations and enables more informed decision-making.

- Automated data gathering from various sources: Systems integrate with third-party data providers, credit bureaus, and other sources to gather additional customer information.

- Improved accuracy of customer information: Data enrichment helps identify and correct errors in customer data, ensuring accuracy and consistency.

- Enhanced risk assessment: Enriched data provides a more complete and accurate view of customer risk, enabling more precise risk scoring and decision-making.

7. Age Verification

Automated age verification systems ensure compliance with regulations related to age-restricted products and services. These systems verify customer age through document analysis and database checks, preventing underage individuals from accessing restricted content or services and reducing legal liability.

- Automated age checks through document analysis: Systems extract and verify age information from government-issued IDs and other documents using OCR and AI.

- Compliance with age-restricted regulations: Automated age verification helps businesses comply with regulations related to alcohol sales, online gambling, and other age-restricted activities.

- Prevention of underage access: Automated checks prevent minors from accessing age-restricted content or services, protecting businesses from legal penalties and reputational damage.

Wrapping Up

Automated KYC verification offers numerous benefits for businesses looking to streamline identity verification processes while maintaining security and compliance.

By adopting AI-driven solutions, businesses can improve efficiency, reduce costs, and enhance the customer experience.

As the regulatory landscape continues to evolve, automated KYC systems provide a proactive approach to compliance, ensuring that businesses remain protected against emerging threats.

Businesses should evaluate their specific KYC needs and consider implementing an automated solution to position themselves for long-term success.

Unlock the full potential of your business with FTx Identity! Contact us today to schedule a consultation and demo.

Cut Down Drop-Offs During Onboarding

FTx Identity can help you meet KYC requirements and elevate customer onboarding.