Running a business today involves handling a complicated set of regulations and compliance requirements.

One key area where businesses often struggle is with Know Your Customer (KYC) compliance. Failure to comply can lead to severe consequences, including heavy fines, legal repercussions, and damage to your business’s reputation.

In this blog post, we’ll explore the importance of KYC compliance, what it entails, and how KYC compliance software can safeguard your business.

What Is KYC Compliance?

KYC is the process businesses use to verify their customers’ identities. This consists of collecting and analyzing different types of information to confirm that customers are who they say they are. The main goal of KYC is to prevent illegal activities like money laundering, terrorist financing, and identity theft.

KYC compliance means following specific regulations and guidelines to protect both businesses and their customers. These standards can vary by location but typically include requirements for customer identification, due diligence, and ongoing monitoring. By adhering to KYC regulations, businesses can reduce risks and create a safer environment for transactions.

Key Components of KYC Compliance

KYC compliance software is designed to streamline and automate the KYC process, making it easier and more efficient for businesses.

The key KYC compliance software components include:

Customer Identification Program (CIP)

The Customer Identification Program (CIP) is the first step in KYC compliance. It involves collecting identifying information from customers, such as name, date of birth, and address, and verifying this information through reliable sources. CIP ensures that individuals are who they claim to be, reducing the risk of fraudulent activities.

Customer Due Diligence (CDD)

Customer Due Diligence (CDD) takes the verification process a step further. It involves assessing the risk level associated with each customer based on their behavior and transaction patterns. By performing CDD, businesses can better understand their customers and identify any red flags that may indicate illicit activities.

Enhanced Due Diligence (EDD)

For high-risk customers, Enhanced Due Diligence (EDD) is necessary. EDD involves a more thorough investigation into the customer’s background, including their source of funds and business activities. This closer examination helps reduce risks related to high-risk clients and ensures compliance with strict regulatory requirements.

Ongoing Monitoring

KYC compliance doesn’t end with the initial verification process. Ongoing monitoring involves continuously reviewing customer transactions and behavior to detect any suspicious activities. By staying alert, businesses can quickly address potential threats and ensure they always comply with regulatory standards.

What Is KYC Compliance Software and How Does It Work?

KYC compliance software is a specialized tool designed to automate and streamline the KYC process. These platforms leverage advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics to provide efficient and accurate customer verification and monitoring.

KYC software works by integrating with business systems to collect and analyze customer data. It can automatically verify the authenticity of identification documents, assess risk profiles, and monitor customer activities in real-time. This automation reduces the time and effort required for manual checks, ensuring consistent and reliable compliance.

By using KYC compliance software, businesses can improve their accuracy and efficiency in meeting regulatory requirements, allowing them to focus on core operations while maintaining high standards of security and compliance.

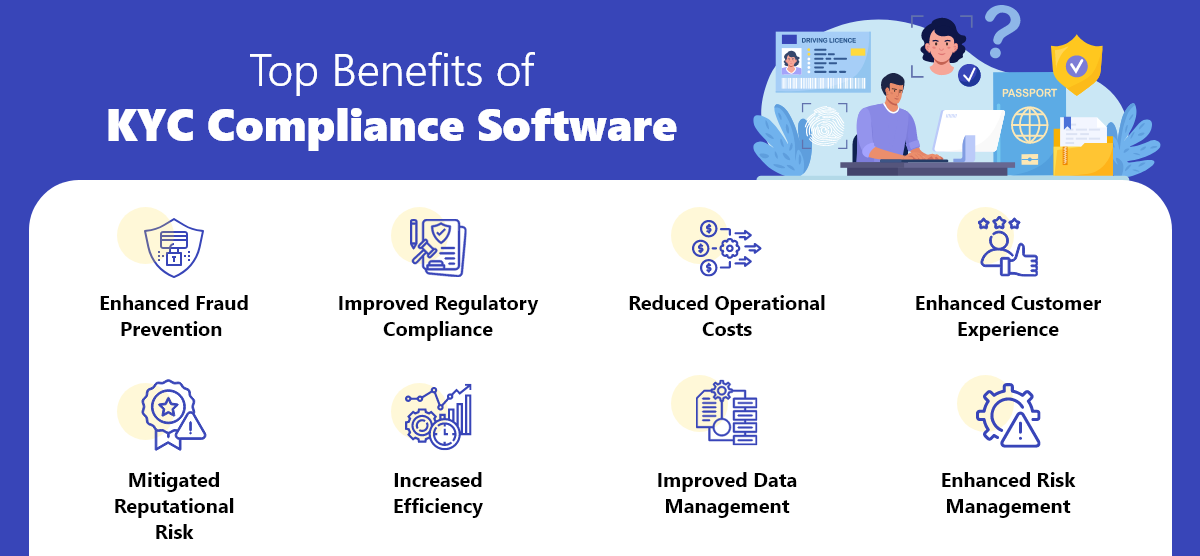

Top Benefits of KYC Compliance Software

Implementing software provides several benefits for businesses, including:

1. Enhanced Fraud Prevention

One of the main benefits of KYC compliance software is its ability to prevent fraud. By automating customer verification and using advanced algorithms to spot suspicious behavior, the software helps businesses identify and reduce potential fraud risks early.

This proactive approach not only protects businesses from financial losses but also strengthens their overall security. It allows them to operate confidently, knowing their customer base is legitimate and trustworthy.

2. Improved Regulatory Compliance

KYC compliance software is designed to help businesses meet regulatory requirements more efficiently. It automates the process of collecting, verifying, and storing customer information, ensuring that businesses can demonstrate compliance with relevant laws and regulations.

The software also provides audit trails and reporting capabilities, making it easier for businesses to track their compliance efforts and produce evidence in case of regulatory inquiries. This streamlined approach to compliance reduces the risk of penalties and legal issues, allowing businesses to focus on their core operations.

3. Reduced Operational Costs

Manual KYC processes can be time-consuming and resource-intensive. KYC software automates these tasks, reducing the need for manual intervention and freeing up valuable resources.

By streamlining the KYC process, the software helps businesses achieve major cost savings. It reduces the need for extra staff and lessens the administrative burden of compliance efforts. This cost-effective approach helps businesses use their resources more efficiently and boost their overall profitability.

4. Enhanced Customer Experience

KYC compliance software not only benefits businesses but also enhances the customer experience. By automating the verification process, the software reduces the time and effort required for customers to complete their onboarding.

This streamlined approach to customer verification ensures a smooth and hassle-free experience for customers, improving their overall satisfaction and loyalty. It also enables businesses to onboard customers more quickly, reducing the time to revenue and enhancing their competitive advantage.

5. Mitigated Reputational Risk

Non-compliance with KYC regulations can severely damage a business’s reputation. KYC compliance software helps businesses avoid these risks by ensuring that they adhere to regulatory requirements and maintain the highest standards of integrity.

By showing a commitment to compliance and customer security, businesses can earn the trust of their customers and stakeholders. This good reputation improves their brand image and strengthens their market position.

6. Increased Efficiency

KYC software significantly improves the efficiency of the KYC process. By automating repetitive tasks and providing real-time insights, the software enables businesses to complete customer verification and due diligence efforts more quickly and accurately.

This increased efficiency reduces the time and effort required for compliance, allowing businesses to focus on their core operations and strategic initiatives. It also helps them respond better to new risks and changes in regulations.

7. Improved Data Management

Effective data management is crucial for KYC compliance. KYC compliance software provides a centralized platform for storing and managing customer information, ensuring that businesses can access and update data easily.

The software also offers robust data security and privacy features, protecting sensitive customer information from unauthorized access and breaches. This enhanced data management capability ensures that businesses can maintain the integrity and confidentiality of their customer data.

8. Enhanced Risk Management

KYC compliance software provides businesses with advanced risk management capabilities. By leveraging AI and machine learning, the software can identify and assess potential risks more accurately and efficiently.

This proactive approach to risk management enables businesses to take appropriate measures to mitigate risks and prevent financial crimes. It also ensures that they can maintain compliance with regulatory requirements and protect their reputation.

How KYC Compliance Software Helps in the Banking Sector

The banking sector greatly benefits from KYC compliance software. Financial institutions deal with strict regulations and the threat of financial crimes. The software helps banks tackle these issues by simplifying customer onboarding, improving risk management, and ensuring they meet regulatory requirements.

1. Streamlining Customer Onboarding

KYC software automates the customer onboarding process, reducing the time and effort required for identity verification and due diligence. This streamlined approach ensures that banks can onboard customers more quickly and efficiently, improving the overall customer experience.

2. Enhancing Risk Management

Banks face major risks associated with financial crimes such as money laundering and fraud. KYC compliance software helps banks identify and mitigate these risks by providing advanced risk assessment and monitoring capabilities.

3. Ensuring Regulatory Compliance

The banking sector faces strict regulations, and failing to comply can lead to serious penalties. This software assists banks in meeting these requirements by automating the collection, verification, and storage of customer information.

4. Improving Customer Experience

By streamlining the verification process, the software enhances the overall customer experience. It reduces the time and effort required for customers to complete their onboarding and ensures a smooth and hassle-free experience.

5. Centralizing Data

KYC software provides a centralized platform for storing and managing customer information. This centralization ensures that banks can access and update data easily, improving data management and security.

Wrapping Up

KYC compliance software is a vital tool for businesses looking to safeguard against fraud, maintain regulatory compliance, and protect their reputation. By automating and streamlining the KYC process, businesses can improve efficiency, reduce operational costs, and enhance the customer experience.

Whether you’re a business owner in the banking sector or another industry, implementing KYC compliance software can help you stay ahead of potential threats and ensure a secure and compliant operating environment.

To learn more about how FTx Identity can benefit your business, reach out to us today to schedule a consultation and check out a demo!