Digital payment systems have revolutionized the way businesses operate, offering speed, ease, and convenience. However, as online transactions grow, so does the threat of payment fraud.

That back in 2023, Juniper Research predicted that merchant losses from online payment fraud would exceed $362 billion globally between 2023 and 2028, with losses of $91 billion alone in 2028?

What is your business doing to protect against such massive risks? Let’s talk!

For merchants, implementing proactive fraud detection and prevention strategies isn’t optional – it’s essential. Leveraging advanced technologies like machine learning (ML) not only adds a layer of defense but also empowers businesses to safeguard finances, build trust with customers, and protect their reputations.

This comprehensive guide dives into the essentials of payment fraud detection and prevention, equipping you with actionable insights and strategies to secure your business from fraudsters.

Understanding Payment Fraud

Before delving into fraud detection and prevention, it’s important to understand what payment fraud is.

What Is Payment Fraud?

Payment fraud refers to any form of unauthorized or illegal transaction carried out by a malicious actor, typically with the intent to steal money or sensitive payment information. These attacks often target online businesses due to the vulnerabilities in digital payment systems.

Common Types of Payment Fraud

- Identity Theft: Fraudsters use stolen personal information to make unauthorized transactions.

- Card-Not-Present (CNP) Fraud: Fraudulent transactions made without physical access to a card, such as in ecommerce purchases.

- Account Takeover: Hackers gain access to customer accounts to steal stored payment data.

- Phishing: Fraudulent schemes trick users into sharing sensitive information, such as login credentials or credit card numbers.

Why Fraud Detection Is Crucial in Digital Payment Systems

Payment fraud poses significant risks to businesses, including financial losses and long-term reputational damage.

Beyond monetary losses, frequent fraud incidents erode customer trust, driving customers away to competitors with reliable security protocols. The bottom line? Fraud detection doesn’t just protect your finances – it protects the core of your customer relationships.

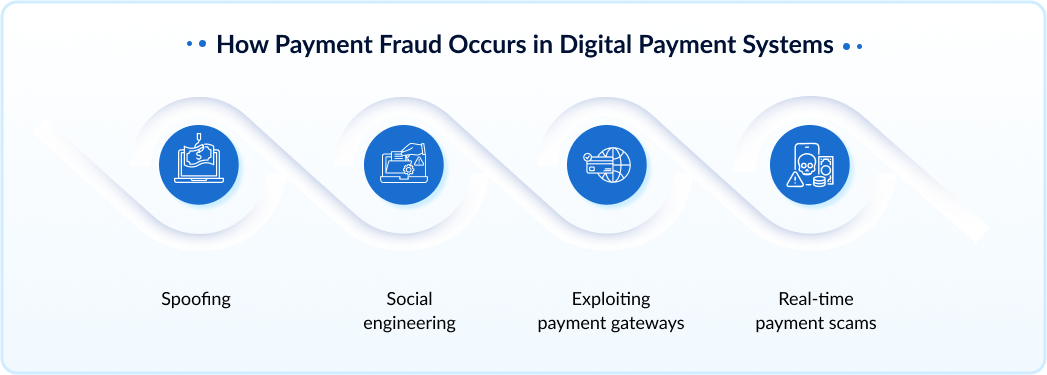

How Payment Fraud Occurs in Digital Payment Systems

Fraudsters continuously evolve their tactics to exploit vulnerabilities in payment systems.

Below are some of the most alarming methods:

- Spoofing: Scammers mimic trusted sources like banks or payment processors to deceive victims.

- Social Engineering: Manipulating individuals into divulging confidential information via email, phone, or social media.

- Exploiting Payment Gateways: Vulnerabilities in payment platforms can offer entry points for unauthorized access.

- Real-Time Payment Scams: The instantaneous nature of real-time payments makes it harder to intercept fraud before it happens.

Examples of Fraudster Tactics

- Spoofing legitimate websites or payment forms to steal sensitive information such as credit card details.

- Bot Attacks, where automated scripts test thousands of stolen credentials to find valid ones.

- Synthetic Fraud creates entirely new identities using fake personal information, leaving businesses to deal with losses before detecting the deception.

Techniques and Tools for Payment Fraud Detection

Detecting payment fraud requires a combination of strategies to counter the growing sophistication of fraudsters.

Traditional Fraud Detection Methods

Historically, fraud detection primarily relied on rule-based systems, where predefined parameters or thresholds are used to identify potentially fraudulent activity. For example, if a credit card transaction exceeds a certain amount or originates from a high-risk region, the system would flag it for review.

- Advantages: These systems are straightforward to implement, cost-effective, and easy for human operators to interpret. They provide clear-cut rules that businesses can quickly deploy without requiring advanced technical expertise.

- Limitations: However, rule-based systems struggle with adapting to the constantly evolving tactics of fraudsters. These static rules often become outdated, leading to higher false-positive rates that inconvenience legitimate customers while allowing more sophisticated fraud attempts to slip through undetected.

Other traditional methods include:

- Blacklists: Blocking transactions from known fraudsters or high-risk accounts. Although effective for catching repeat offenders, this approach is limited by its reliance on historical data and cannot account for new fraudsters.

- Velocity Checks: Flagging unusual transaction volumes, such as multiple charges within a short time frame. While useful in some cases, velocity checks can generate false alarms, especially for legitimate users with high transaction activity.

Modern Fraud Detection with Machine Learning

The emergence of artificial intelligence (AI) and machine learning (ML) has brought a major leap forward in payment fraud detection. These advanced technologies allow systems to go beyond static rules by learning from historical data and adapting to new patterns of fraudulent behavior.

Supervised Learning

This approach involves training ML models on large, labeled datasets that clearly distinguish between legitimate transactions and fraudulent ones. The system learns from these examples to predict and classify future transactions with high accuracy. Over time, supervised models can improve their detection capabilities by incorporating newly labeled data, making them highly effective in identifying known types of fraud.

Unsupervised Learning

Unlike supervised learning, unsupervised techniques do not rely on labeled datasets. Instead, they focus on recognizing patterns and anomalies within the data that deviate from the norm. This makes unsupervised models particularly powerful for detecting new and previously unseen fraud tactics, as they are not limited by predefined categories.

Example: JPMorgan Chase has taken proactive steps to combat threats by leveraging machine learning to monitor online transactions in real-time. It was found back in 2024 that the bank had embraced advanced technologies that have led to a remarkable 50% decrease in credit card fraud losses over the past five years.

Building a Fraud Detection Framework for Your Business

Creating a reliable fraud detection framework is essential in protecting your business and its customers from financial losses and reputational harm.

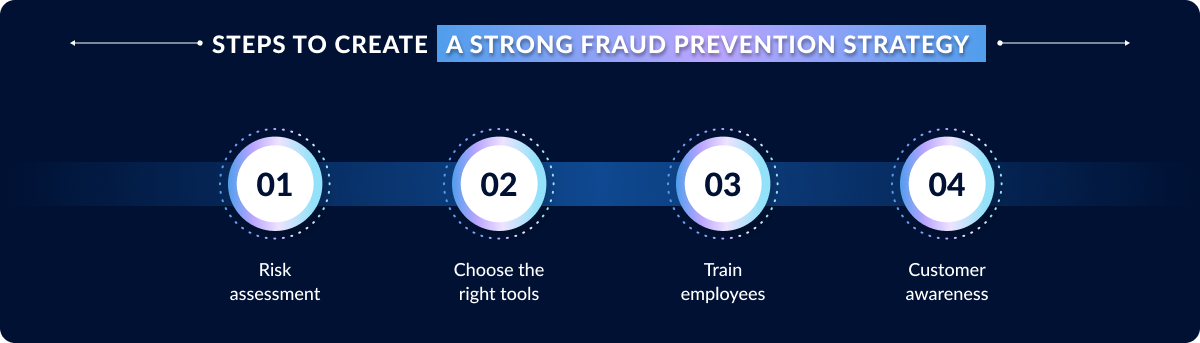

Here’s a step-by-step guide to developing a strong fraud prevention strategy:

Steps to Create a Strong Fraud Prevention Strategy

1. Risk Assessment: Identify weaknesses in your payment systems.

2. Choose the Right Tools: Select payment fraud detection software that aligns with your business needs.

3. Train Employees: Educate your staff on recognizing suspicious activities.

4. Customer Awareness: Teach your customers about safe transaction practices, such as recognizing phishing emails.

Integrating Fraud Detection with Payment Gateways

To minimize disruptions, it’s essential to integrate fraud detection systems seamlessly with your existing payment gateways. Features like real-time alerts and detailed transaction logs can further enhance fraud response times.

Compliance and Legal Considerations

Fraud prevention must align with regulatory standards such as the Payment Card Industry Data Security Standard (PCI DSS) to ensure data security. Adhering to data protection laws like the General Protection Regulation (GDPR) or California Consumer Privacy Act (CCPA) is equally critical to avoid legal complications.

Benefits of Real-Time Payment Fraud Detection

Real-time fraud detection provides several key benefits that are essential in today’s fast-paced digital payment environment:

Faster Response Times

By identifying and blocking fraudulent activities instantly, businesses can prevent financial losses and protect both themselves and their customers. This rapid response minimizes the impact of fraud, ensuring threats are dealt with before they escalate.

Enhanced Customer Trust

Customers are more likely to trust businesses that take proactive steps to secure their payments. A secure payment process reassures users that their personal and financial information is protected, fostering long-term loyalty and a positive reputation for the business.

Reduced False Positives

A strong fraud detection system doesn’t just block fraudulent transactions – it also reduces the chance of mistakenly flagging legitimate payments. This ensures a smoother, hassle-free customer experience, allowing valid transactions to proceed without unnecessary delays or interruptions.

Key Metrics to Measure the Effectiveness of Fraud Detection Systems

To ensure your payment fraud detection system is performing optimally and protecting your business, it’s essential to track specific key metrics. These metrics help identify strengths, weaknesses, and areas for improvement in your fraud prevention strategy.

Key metrics to monitor include:

- Fraud Detection Rate: This is the percentage of successful fraud attempts identified by your system. A high fraud detection rate indicates that your system is effectively catching fraudulent activity before it causes harm.

- False Positive Rate: The percentage of legitimate transactions incorrectly flagged as fraudulent. A high false positive rate can frustrate customers and lead to unnecessary transaction declines, impacting user experience and revenue.

- Chargeback Ratio: This is the number of chargebacks (disputed transactions) compared to the total number of transactions. A high chargeback ratio can indicate gaps in fraud prevention and may lead to financial penalties or damage to your business reputation.

- Customer Dispute Ratio: This measures the frequency of customer-reported fraud cases. A rising dispute ratio can signal that fraudulent transactions are slipping through the cracks, highlighting areas where your system needs improvement.

By regularly analyzing and optimizing these metrics, you can create a robust fraud detection strategy that minimizes risk and improves customer trust.

Future of Payment Fraud Detection

Emerging trends are paving the way for major advancements in fraud prevention, offering businesses and consumers stronger protection against evolving threats.

Biometric Authentication

Technologies like fingerprint scanning and facial recognition provide more secure and personalized ways to verify identities. These methods are harder to fake and add an extra layer of security to transactions.

Blockchain Technology

By creating a decentralized and transparent ledger, blockchain ensures every transaction is traceable and tamper-proof. This reduces opportunities for fraud by making it nearly impossible to alter or manipulate transaction records.

Evolving AI/ML Models

Artificial intelligence and machine learning are becoming smarter every day. These models analyze vast amounts of data to detect anomalies, identify suspicious patterns, and quickly adapt to new tactics used by fraudsters, ensuring more precise and proactive fraud detection.

These innovations are set to transform how payment fraud is detected and prevented, helping businesses stay ahead in the fight against financial crime.

Conclusion

Proactive fraud detection in payments is more than just a security measure – it’s essential for running a successful business. For merchants, using fraud detection tools helps ensure smoother operations, happier customers, and long-term success.

With the insights in this guide, you’re prepared to tackle payment fraud directly. Whether you run a small business or a large organization, modern fraud prevention systems can protect your transactions and build your reputation.

To learn more about how FTx Identity can transform your business, be sure to reach out to us to schedule a consultation and experience a demo!