Synthetic identity fraud is an emerging ID fraud tactic that’s difficult to detect. Unlike traditional identity fraud, synthetic fraud uses real ID data and fabricated data to create a new identity.

Criminals then use these created identities to open credit accounts, conduct financial crimes, and run fraudulent transactions.

Ultimately, synthetic ID fraud is one of the fastest growing forms of fraud and it’s so difficult to detect because criminals target individuals who might not check their credit regularly. How can you protect yourself? Prevention is the first key. You should learn to understand how this form of fraud works. Then, you can begin to protect yourself, so your data isn’t used to create a synthetic ID.

What Is Synthetic Identity Fraud?

Synthetic identity fraud is a form of Identity (ID) theft. It involves creating so-called synthetic identities, using real data (like an SSN) and fabricated data.

This is happening increasingly in the U.S., because U.S. identity verification systems tend to rely on personally identifiable information. This can include driver’s license ID numbers, passport numbers, your social security number or date of birth. This data is then combined with other real and fake data to create difficult-to-trace fraudulent identities.

With these identities, criminals can open bank and credit accounts, conduct business with governmental agencies, or commit other forms of identity fraud.

Almost half (46%) of businesses globally have experienced synthetic identity fraud – Regula.

Has your business faced the same challenge?

What If My Identity Is Used in Fraud?

Ultimately, if your data has been used to create a synthetic identity, some of the implications include:

- Credit Risk: A synthetic identity tied to you could harm your credit score, e.g. the criminal misses payments, making it tougher for you to get loans later.

- Legal Hazards: A fake identity could engage in illegal activities that put you at risk for legal troubles, like tax evasion or financial crime.

- False Accusations: You could be wrongly linked to criminal activities if authorities confuse the synthetic identity with you, leading to legal issues.

- Resolution Hurdles: Fixing the fallout from synthetic identity fraud can be complex and time-consuming, involving law enforcement and credit agencies.

- Emotional Toll: Dealing with synthetic identity issues can cause stress and anxiety.

- Legal Entanglement: You could face legal action wrongly based on the actions of the synthetic identity, requiring evidence to clear your name.

Protect yourself. Learn about the latest fraud risks that target individuals and businesses.

How Are Synthetic Identities Created?

Like traditional fraud, synthetic ID fraud involves gathering or stealing personal ID information. Once stolen this information can be fed into fraud tools to create hundreds of synthetic IDs.

Here’s a step-by-step guide to how fraudsters create and use synthetic identities:

Step 1: Gather information

Fraudsters gather personal information they need to build a synthetic identity—including name, date of birth, address, phone number, etc. In some cases, this can be done by purchasing stolen data online or from dark web providers. In other cases, fraudsters may use “data scraping” technology to gather data from public sources.

At financial institutions, it’s estimated that 95% of synthetic identities are not detected during the onboarding process – Legal Thomson Reuters

Step 2: Create the Synthetic Identity

Once the information has been gathered, it’s time to create a new synthetic identity—often using a tool called an “identity mill.” An identity mill is an automated system that can generate hundreds or even thousands of fake identities. This tool allows fraudsters to combine pieces of real data with fictitious information to create a unique identity.

Step 3: Use the Synthetic Identity

Fraudsters can use a synthetic identity for various purposes. This could include opening new accounts, taking out loans, or even applying for credit cards. In some cases, a criminal may even use the identity to create false medical records or obtain government benefits.

Step 4: Monitor the Identity

Finally, the fraudster will monitor the synthetic identity over time to ensure that it is not detected. This could include using automated “bot” technology to search for any signs of suspicious activity associated with the identity. If anything looks out of place, the fraudster can take steps to cover their tracks before law enforcement can catch up.

Synthetic vs Traditional Identity Theft

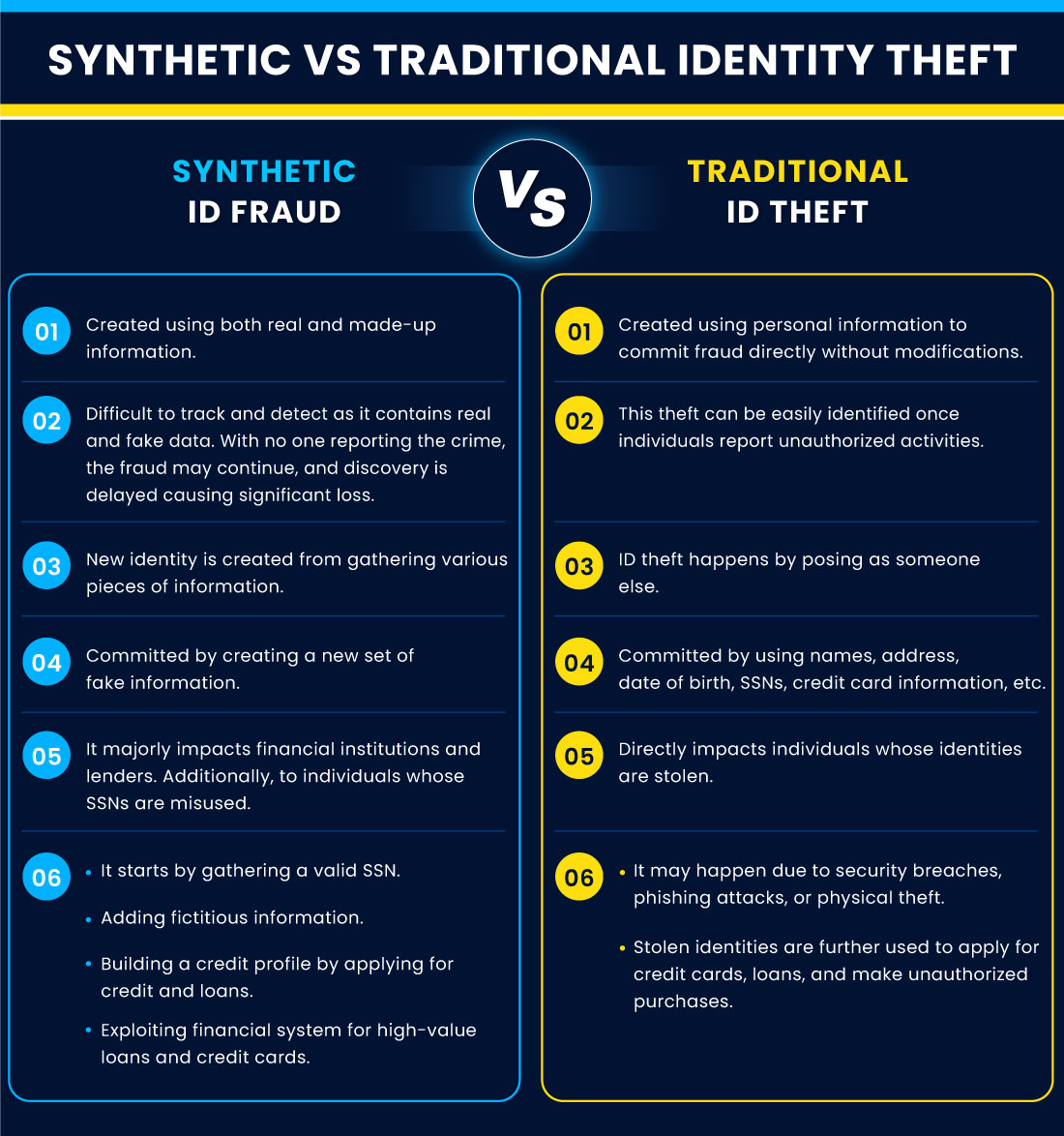

Traditional ID fraud involves stealing personal information to commit fraud without modifying any details. Whereas synthetic ID theft involves creating a new fictitious identity by mixing real and fabricated information.

Take a quick glance at the below listed key differences between synthetic and traditional identity theft.

Types of Synthetic Identity Theft

Synthetic identity theft primarily occurs in two forms: manipulated and manufactured identities. Let’s explore them one by one.

1. Manipulated Synthetics

As the name suggests, this type of theft is done by manipulating a few details or elements into real data. These fraudulent identities are based on real people’s personal information with minor modifications like altered addresses or date of birth.

These manipulated identities are created by fraudsters to cover up financial history and gain access to new credit with an intent to repay it. Organizations have easy ways to detect these manipulated identities, and the major giveaway is that they often do not pass the validity checks.

2. Manufactured Synthetics

Manufactured synthetic ID fraud is usually done by fabricating data put together from multiple identities. It is generally referred to as ‘Frankenstein Fraud’ as fraudsters create these identities by mixing real elements.

For example, a fraudster may create a fake name, date of birth, and address while keeping a genuine SSN. Such frauds are often seen nowadays, as they pick the same range of SSN which is randomly issued by SSA (Social Security Administration). The manufactured synthetic ID fraud is hard to detect with current techniques.

How to Prevent Synthetic Identity Theft: 7 Essential Tips

Synthetic identity fraud can hurt businesses and individuals. After you understand how this threat works, you can take these steps to boost personal data security:

1. Keep a Close Eye on Your Accounts

The best course of action is to monitor your accounts and/or use account monitoring tools:

Stay Alert: Check your business accounts and transactions often. If you catch any strange things happening early, you can stop them from becoming big problems and costing you a lot of money.

Activate Alerts: Use the special tools your bank provides to keep an eye on your accounts. These tools can send you quick messages if they see anything suspicious, so you can take action right away to keep your business safe.

2. Safeguard Confidential Information

Prevention starts with data security:

Centralize Sensitive Data: Keep important business information, like bank statements and private employee details, in one safe place that’s locked up.

Implement Access Control: Make sure only the people who are allowed can get to the private information. This way, you lower the chances of someone who shouldn’t be seeing it and causing problems.

Start with digital identity verification solutions to eliminate threats, improve security, and increase trust. Read how…

3. Implement Strong Password Practices

Improving your password security is one of the easiest (and most effective) strategies to protect yourself:

Establish Password Policies: Make some rules for your employees about passwords. Tell them to create passwords that are really strong and to change them often.

Educate on Password Security: Teach your team how to keep their passwords safe. Tell them to use different passwords for different things and never to tell anyone their passwords. This helps keep your business information safe from criminals.

4. Activate Two-Factor Authentication (2FA)

Use dual-factor authentication and other enhanced verification tactics:

Strengthen Authentication: Require the use of two-factor authentication for accessing sensitive business accounts. This adds an extra layer of security beyond passwords.

Choose Strong Authentication Methods: Opt for authentication methods such as authentication apps or hardware tokens for added security.

5. Regularly Review Credit Reports

You can set up monitoring with a credit report agency like Equifax:

Routine Audits: Regularly obtain and review your business credit report to identify any unauthorized accounts or suspicious activities.

Immediate Reporting: If you notice any inaccuracies or unfamiliar accounts, report them to the credit bureaus immediately to prevent further damage.

6. Be Skeptical of Unsolicited Communications

Take precautions to avoid phishing attempts:

Train Your Team: Educate your employees about the risks of sharing business information in response to unsolicited requests. Encourage them to verify such requests through official channels.

Phishing Awareness: Conduct phishing awareness training to help employees recognize and avoid phishing attempts, which often lead to identity fraud.

7. Educate Your Team on Synthetic Identity Fraud

Grow awareness among your team:

Provide Comprehensive Training: Organize workshops or training sessions to familiarize your team with synthetic identity fraud and the specific tactics used by fraudsters.

Promote a Culture of Vigilance: Create an environment where employees feel comfortable reporting anything suspicious, they notice. By working together to stop fraud, we can prevent problems from happening.

>>> Learn more ways businesses can protect themselves from identity fraud.

Final Thoughts

Integrating these strategies into your business practices will elevate your resilience against synthetic identity fraud. By concentrating on proactive prevention and fostering a company-wide commitment to security, you can elevate your business’s protection, preserve its reputation, and cultivate trust among customers and partners.

Remember, safeguarding your business from synthetic identity fraud is not just a duty— it’s an essential investment in securing its enduring success.

Ready to learn more about FTx Identity? Reach out to us today to schedule a consultation and experience a demo!

Protect Your Business From Synthetic Fraud

Safeguard your customers and strengthen your defenses against the growing threat