Utility bill scams are on the rise, leaving consumers and businesses vulnerable to fraud, identity theft, and financial loss.

With digital communication becoming more prevalent, scammers have found new ways to exploit unsuspecting victims.

Whether you’re a homeowner, business owner, or landlord, it’s important to know how to spot fake utility bills.

This blog will help you identify the signs of fake bills and give you steps to verify them.

What Is a Fake Utility Bill?

A fake utility bill is a fraudulent document used to trick people or businesses into paying scammers. These scams typically target residential customers by providing fake electricity, water, or gas bills. Businesses and landlords are also at risk because they may receive fake documents meant to deceive accounting departments into paying bogus invoices.

Fake bills typically look unprofessional. Fake bills may appear unprofessional with obvious errors or inconsistencies, making them relatively easy to spot if you know what to look for.

Common Utility Bill Scams

Utility bill scams can come in many shapes and sizes. They typically involve tricking people into providing sensitive information or making fraudulent payments.

1. Utility Provider Impersonation

One common approach is for scammers to impersonate legitimate utility companies. They might send emails or make calls, acting like a utility provider, to trick consumers into sharing personal details or sending money to them.

2. Fake Bill Creation

Scammers create fake bills by either changing up real ones or making completely fake documents. They usually use advanced design methods to make these bills look real, tricking people into paying what they think they owe.

3. Social Engineering

This consists of using psychological tricks to persuade people to give up sensitive information or making unauthorized transactions. They often employ scare tactics, such as threatening to disconnect services, to pressure victims into compliance.

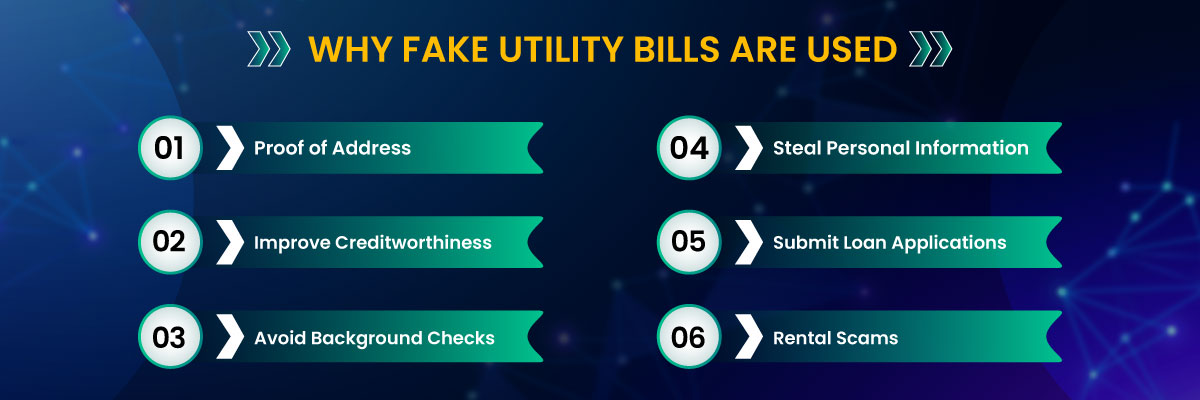

Why Fake Utility Bills Are Used

The misuse of fake utility bills spans numerous malicious activities, each with its own target and objective.

1. Proof of Address

Some people use fake utility bills to create false proof of residency, allowing them to claim a fake address. This can be used for illegal activities like securing jobs, getting into schools, or accessing services that require residency proof.

2. Improve Creditworthiness

Fake utility bills can be used to boost creditworthiness artificially by making a person appear more financially stable to lenders and landlords. This can lead to getting loans, credit cards, or rentals that they wouldn’t otherwise qualify for.

3. Avoid Background Checks

Fake address proof can help scammers bypass background checks, allowing them to get loans, rentals, or jobs without scrutiny that might reveal their criminal past or financial instability.

4. Steal Personal Information

Utility bills contain personal information valuable to identity thieves, who can use it to open accounts or make purchases in someone else’s name, damaging their credit and finances.

5. Submit Loan Applications

Fraudsters might use fake utility bills to apply for loans based on nonexistent income or assets, tricking lenders into financial losses.

6. Rental Scams

In rental scams, fake utility bills are shown to property owners to fraudulently lease apartments or houses, often resulting in missed rent or property damage.

Key Indicators of a Fake Utility Bill

Utility bill scams can be tricky, but there are clear signs that can help you spot a fake document.

Here’s how to identify a fake utility bill:

1. Incorrect Contact Information

Always verify the contact details on your utility bill. Fake bills might have incorrect phone numbers, emails, or misleading information that can go unnoticed. Compare these details with official sources or past bills to ensure accuracy.

2. Inconsistent Branding or Logos

Check the branding or logos on the bill for accuracy. Look for wrong or outdated logos, mismatched colors, or details that don’t match the company’s official brand. Scammers often miss these details, which can signal a fake bill.

3. Unusual Payment Requests or Methods

Utility companies usually accept standard payment methods like direct deposit or credit cards. If asked to pay using gift cards, cryptocurrency, or wire transfers, it’s likely a scam. Question any unusual payment requests.

4. Missing or Incorrect Account Information

Make sure the account numbers and customer information on your bill are correct and match previous statements. Discrepancies could indicate a fake or altered bill.

5. Suspicious or Unexplained Charges

Watch out for unexpected fees or charges. Verify these charges, as they might be attempts to overcharge you. Contact your utility provider to clarify any suspicious charges.

6. Urgent Threats of Service Disconnection

Scammers might claim your service will be disconnected unless you pay immediately. Always verify such claims directly with your utility provider before taking action.

7. Poor Quality or Unprofessional Formatting

Check the visual quality of the utility bill. Fake bills often have poor printing, strange layouts, or unprofessional formatting, indicating they aren’t from an official utility company.

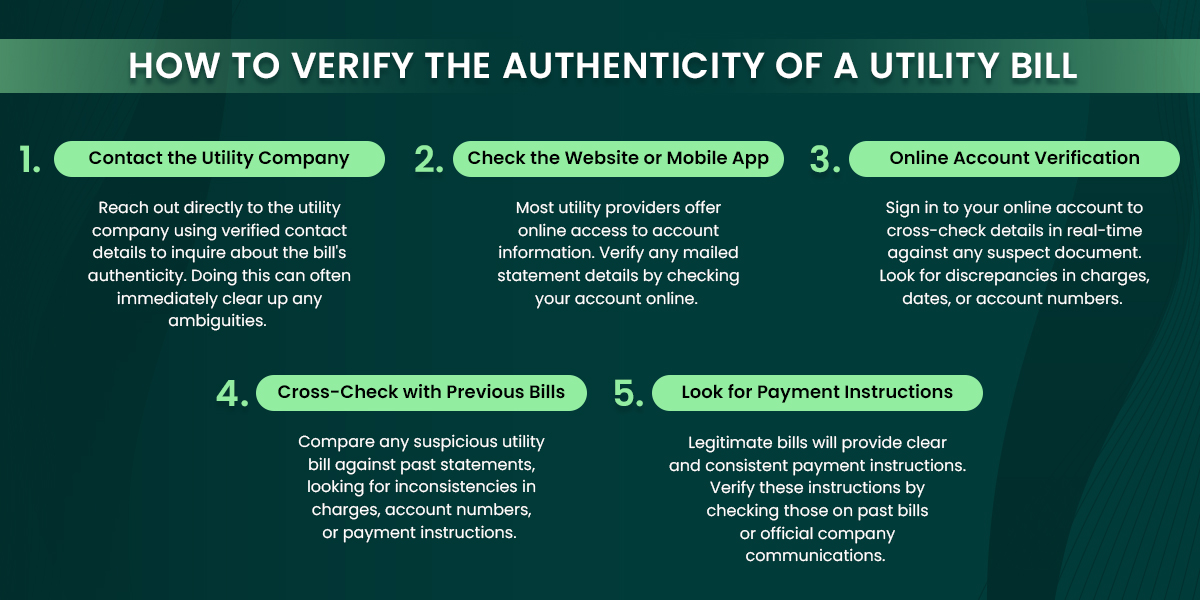

How to Verify the Authenticity of a Utility Bill

Taking more steps to verify the authenticity of a utility bill will help prevent falling victim to these types of scams.

1. Contact the Utility Company

Reach out directly to the utility company using verified contact details to inquire about the bill’s authenticity. Doing this can often immediately clear up any ambiguities.

2. Check the Website or Mobile App

Most utility providers offer online access to account information. Verify any mailed statement details by checking your account online.

3. Online Account Verification

Sign in to your online account to cross-check details in real-time against any suspect document. Look for discrepancies in charges, dates, or account numbers.

4. Cross-Check with Previous Bills

Compare any suspicious utility bill against past statements, looking for inconsistencies in charges, account numbers, or payment instructions.

5. Look for Payment Instructions

Legitimate bills will provide clear and consistent payment instructions. Verify these instructions by checking those on past bills or official company communications.

How Does the Use of a Fake Utility Bill Impact a Bank?

The impact of fake utility bills affects more than just individuals; banks also face significant challenges when dealing with these forgeries.

1. Financial Losses

When banks deal with counterfeit documents, they risk major financial losses. Fake utility bills can invalidate numerous transactions, affecting the bank’s financial health. These losses are worsened by the costs of investigating and resolving fraud.

2. Legal Penalties

Banks that fail to detect fraud involving fake utility bills can face serious legal consequences. Regulatory bodies have strict compliance requirements, and neglecting these can result in costly fines. These legal issues not only strain a bank’s finances but also divert resources from core activities.

3. Criminal Charges

Sometimes, banks that inadvertently enable fraud with fake utility bills may face criminal charges. Even if resolved, such charges can harm the bank’s operations and reputation. This damage may deter clients and partners, affecting business growth.

4. Lost Trust

Trust is key in banking, and its loss can have major impacts. Clients may lose trust and withdraw business due to perceived mishandling of fraud cases. This can decrease the customer base and loyalty, impacting the bank’s competitiveness.

5. Business Closure

If security measures fail and fraud continues, banks risk operational suspension or closure. Banks unable to handle fraud may not sustain operations, leading to possible closure. Robust fraud prevention is essential for the survival of a bank.

Technology to Help Detect Fake Utility Bills

New technologies are being used more and more to spot and stop utility bill scams effectively.

1. Document Verification Tools

Advanced document verification tools use optical character recognition (OCR) and artificial intelligence (AI) to carefully analyze and verify documents. These tools scan utility bills, checking for any signs of tampering or forgery to ensure the documents are genuine and accurate.

2. AI and Blockchain Solutions

Combining artificial intelligence with blockchain technology provides a strong defense against fake utility bills. AI can examine patterns and spot irregularities in billing data, while blockchain offers a secure, unchangeable record that tracks and verifies each transaction step. This combination makes it much harder for fraudulent bills to go unnoticed, ensuring greater security and trust in billing processes.

Steps to Take If You’ve Received a Fake Utility Bill

Discovering a fake utility bill is unsettling, but acting on the issue quickly can significantly lessen its impact.

1. Contact the Utility Provider Directly

Alert your utility provider to verify whether any payment is genuinely owed. Doing this ensures any discrepancies are swiftly ironed out.

2. Report the Scam to Authorities

Use available crime-reporting resources to notify law enforcement. This information can help authorities track down and stop fraudsters in their tracks.

3. Freeze Accounts and Monitor for Fraud

By freezing your accounts early, you can prevent further transactions as you keep a close eye on your financial records for fraudulent activities.

4. Dispute the Charges with the Provider

Challenge any discrepancies on your bill directly with the utility provider, and demand verification for the utility bill if anything seems amiss.

5. Alert Your Bank or Payment Service

Ensure your bank or payment service is aware of any suspicious activity associated with your accounts.

Preventative Measures Against Utility Bill Scams

Being proactive in protecting yourself, your family, and your business against utility bill scams can prevent costly mistakes.

1. Educate Yourself and Your Family

Knowledge is power. By arming yourself and your family with scam identification information, you stay one step ahead of potential deceit.

2. Use Secure Payment Methods

Favor secure and traceable payment avenues over untraceable methods like gift cards that offer scammers easy options to exploit.

3. Enable Account Alerts

Request email or SMS alerts from your utility provider regarding due bills, modifications in charges, and when payments are made.

Protecting Your Business from Utility Bill Scams

Businesses face unique dangers from scam attempts. However, understanding why you may be targeted allows you to take the right steps to prevent it.

Why Businesses Are Targeted

Scammers may target businesses for bigger financial gains due to their larger utility bills and complex billing systems. With higher utility use, businesses get larger bills. This makes them appealing targets for scammers looking for large payouts.

The busy nature of business operations can lead to less scrutiny of charges, allowing fraudulent invoices to go unnoticed. It’s important for businesses to be aware of these vulnerabilities to implement effective protections and avoid being caught off guard.

Steps for Businesses to Prevent Scams

Businesses should institute measures to safeguard against financial fraud through scams.

1. Verify Bills Directly with Utility Providers

Encourage direct verification of bills received with official service providers to nip inconsistencies in the bud.

2. Establish Clear Invoice Review Protocols

Create standardized guidelines that ensure each invoice undergoes thorough verification before processing.

3. Train Employees on Scam Detection

Provide team members with insights into recognizing scams before payment processes are triggered.

4. Use Secure Payment Methods

Transact using routes with traceable, secure trails that deter fraudulent submissions, fostering integrity in the payment process.

5. Monitor for Unusual Billing Changes

Regularly scrutinize billing changes to detect anomalies early before they escalate into significant fraudulent actions.

Wrapping Up

Utility bill scams pose a significant threat to consumers and businesses alike. By being aware of the traits of fake utility bills and understanding common scam tactics, you can protect yourself from falling victim to fraud. Regularly educate yourself and family members on scams, verify bills directly with utility providers, and use technology to aid in detecting fake bills. Stay informed and vigilant to safeguard your finances and identity from these deceptive schemes.

For additional resources and verification tools, explore our document verification services today by getting in touch with us to schedule a consultation and experience a demo!