ID.me has quickly grown into a big name in identity verification online.

The platform – which specializes in age verification and digital wallets – is widely used for governmental user authentication. However, as ID.me has grown, so too has the need for alternatives. For many retailers, questions like “Is ID.me safe?” and “Is ID.me legit?” are top of mind when choosing a verification partner.

So, what exactly is ID.me? Is it safe? And what are the best alternatives?

This guide takes a closer look at the platform and offers a comparison of ID.me and FTx Identity.

What Is ID.me?

ID.me is a leading digital identity solutions provider, offering a service designed to verify individuals’ identities online to prevent fraud. As one of the prominent identity verification tools on the market, it provides websites and agencies a platform to authenticate users. Users can verify their identities with facial recognition, which adds a critical layer of security. For any business owner, understanding how secure ID.me is becomes an essential part of evaluating identity verification tools.

Established in 2010 by Blake Hall and Matt Thompson as TroopSwap, initially resembling Craigslist, ID.me evolved into a Groupon-like discount service catering to the military. Transitioning to Troop ID, the platform focused on digital identity verification for military personnel and veterans, granting them online benefits.

In 2013, a rebranding to ID.me aimed at creating a universal, secure identity verification network. Expanding further, the platform now verifies credentials for first responders, nurses, and students.

Today, numerous state and federal government agencies use ID.me for user authentication, a key reason it’s often listed among the best ID verification software options. This is because it was approved by the US National Institute of Standards and Technology, reinforcing its position as a contender for the best identity verification software for government use.

What Are the Features of ID.me?

1. Multi-Factor Authentication (MFA): ID.me employs multi-factor authentication to ensure a higher level of security. This typically involves a combination of factors such as something you know (password), something you have (a mobile device), and something you are (biometric data).

2. Facial Recognition Technology: ID.me utilizes facial recognition technology for identity verification. Users may be required to submit a selfie to be matched against an internal database, adding an extra layer of biometric security.

3. Secure Access to Online Accounts: One of the primary purposes of ID.me is to grant users secure access to their online accounts. This is often used in various sectors, including government services and financial transactions.

4. Fraud Prevention: The platform is designed to prevent fraud by verifying the authenticity of individuals’ identities. This is particularly crucial in contexts like tax filing and government benefit programs.

5. Real-Time Video Verification: In response to concerns and criticisms, ID.me introduced an option for users to verify their identity through a live video chat with an ID.me agent. This provides a real-time alternative to submitting biometric data.

6. Ease of Integration: ID.me aims to be user-friendly and is often integrated into various online platforms, allowing organizations to incorporate its identity verification features seamlessly.

Concerns About ID.me

While ID.me is a major player, it’s crucial for retailers to be aware of the full picture. Choosing identity verification tools is about trust and reliability.

Let’s look at some concerns that have emerged, because when you integrate a tool into your checkout, its issues become your issues.

1. Privacy controversy and public debate around biometrics

ID.me’s use of facial recognition has placed it at the center of the biometric data privacy debate. For retailers, using a tool that collects such sensitive data comes with a responsibility to understand how it’s handled.

- The core concern revolves around customer consent and the ethical use of biometric information.

2. Concerns about the storage of face recognition data

A primary question for businesses is, “Is ID.me secure when it comes to data storage?” The storage of highly sensitive biometric templates is a prime target for cyberattacks. A breach could have severe consequences not just for ID.me but for the businesses that rely on it, damaging customer trust.

- This creates a significant data liability consideration for any merchant.

3. False positives and verification errors

No system is perfect. Some users report failing verification despite providing valid ID, a problem known as a “false positive.”

For you, the retailer, this can mean:

- Turning away legitimate customers and losing sales.

- Creating a frustrating experience that damages customer loyalty.

4. Issues with accessibility

Not all customers have access to a smartphone with a high-quality camera or a reliable internet connection. Relying solely on a tool that requires these can unintentionally exclude segments of your customer base, like the elderly or those in areas with poor connectivity.

5. Wait times during peak periods

During times of high demand, users have reported long virtual “waiting room” times to complete verification.

- In a retail setting, a customer facing a long delay at checkout is likely to abandon the purchase entirely.

6. Vendor lock-in and reliance on a single provider

Integrating any single provider deeply into your operations can lead to vendor lock-in. This can make it difficult and costly to switch to a different best identity verification software later if your needs change or prices increase.

7. Growing demand for alternatives with more transparency

These concerns have fueled the search for alternatives. Many businesses are now actively seeking digital identity solutions that prioritize:

- Greater transparency in their technology and data policies.

- More control for the business owner over the verification process.

- A smoother, more reliable experience for the end customer.

Is ID.me Safe?

Despite being widely utilized for identity verification, ID.me has drawn criticism for a perceived lack of transparency and operational efficiency.

In recent years, ID.me faced significant controversy, particularly highlighted by the 2022 dispute with the IRS. The exclusive partnership between ID.me and the IRS was terminated, likely due to performance issues.

A House Oversight Committee investigation in November 2022 revealed that ID.me had inaccurately reported the duration of its identity verification services, leading lawmakers to question the platform’s reliability.

Two U.S. House committees found that ID.me deliberately exaggerated welfare fraud figures during the pandemic while downplaying the waiting times individuals endured for virtual interviews to access government benefits. This series of events underscored concerns about ID.me’s accuracy and transparency.

In 2021, ID.me asserted that only 10-15% of benefit applicants, unidentifiable by its facial recognition technology, would face a two-hour wait. Contrary to this claim, actual wait times surpassed four hours on average in the majority of states employing ID.me and exceeded nine hours on average in certain states. This discrepancy between the stated and actual wait times underscored challenges and raised concerns about the accuracy of ID.me’s information regarding the duration of identity verification processes.

Why Businesses Are Looking for ID.me Alternatives

The concerns surrounding ID.me aren’t just theoretical—they have real-world impacts on business operations and the bottom line. For retailers, the goal is to verify age or identity without losing a sale or damaging customer trust. This is why many are actively seeking digital identity solutions that offer a better balance of security, speed, and transparency.

1. Need for faster, frictionless verification

In retail, every second counts. A slow or clunky verification process at the checkout line can lead to abandoned purchases and frustrated customers. Businesses need identity verification tools that are:

- Fast: Near-instantaneous results to keep lines moving.

- Frictionless: A simple process that doesn’t require multiple steps or apps.

2. Focus on user privacy and data control

As consumers become more aware of data privacy, they prefer businesses that respect it. Using a verification tool that is perceived as invasive can harm your brand’s reputation. Companies are now prioritizing partners who offer robust security and clear data policies, making “is ID.me secure” a starting point, not the end goal, for their evaluation.

3. Regional compliance (GDPR, CCPA)

For businesses operating in multiple regions or online, compliance is non-negotiable. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in California have strict rules on biometric data. Many are seeking alternatives built to comply with these specific legal frameworks from the ground up, reducing compliance risk.

4. Integration flexibility and cost efficiency

Businesses need tools that adapt to their existing tech stack, not the other way around. The ideal best ID verification software should offer:

- Easy application programming interface (API) integration with existing point of sale (POS) and e-commerce systems.

- Transparent, predictable pricing that scales with business needs.

5. Growing competition in the digital ID landscape

The market for digital identity solutions has exploded. This competition drives innovation, leading to better features, higher accuracy, and more competitive pricing. Businesses are exploring this new landscape to find providers that are more agile, responsive, and tailored to the specific needs of retail.

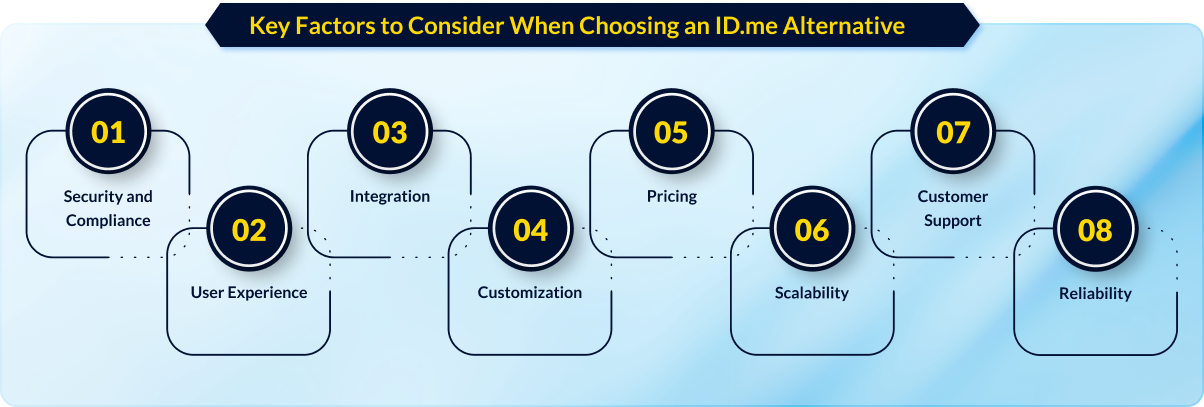

Key Factors to Consider When Choosing an ID.me Alternative

Switching your identity verification tools is a big decision. You need a partner, not just a product. To find the right fit for your retail business, it’s essential to look beyond the basics and evaluate alternatives against a checklist of critical factors that impact your daily operations and long-term growth.

1. Security and Compliance

This is a non-negotiable foundation. Any alternative must be unquestionably secure and compliant.

- Look for providers that are transparent about their data encryption, storage policies, and compliance with regulations like GDPR and CCPA.

- The Goal: Ensure the tool protects your business from liability and builds customer trust.

2. User Experience

A secure tool is useless if it drives customers away. The verification must be fast and simple.

- Seek digital identity solutions that offer a frictionless process, minimizing steps and wait times at the point of sale.

- The Goal: Verify age or identity without sacrificing speed or creating checkout friction.

3. Integration

Your new software should slide easily into your existing tech stack.

- Prioritize solutions with flexible APIs that connect seamlessly with your POS, e-commerce platform, and loyalty programs.

- The Goal: Avoid technical headaches and ensure a smooth workflow for your staff.

4. Customization

Every retail business is unique. Your verification tool should adapt to your specific needs.

- Can you adjust the verification rules or customize the user interface to match your brand?

- The Goal: Have control over how the tool works within your specific operational flow.

5. Pricing

Understand the total cost of ownership. The cheapest option isn’t always the most cost-effective.

- Look for transparent, predictable pricing models without hidden fees. Evaluate the return on investment in terms of reduced fraud and improved operational efficiency.

- The Goal: Gain a powerful tool that fits your budget and delivers clear value.

6. Scalability

Your business is growing; your tools need to keep pace.

- Choose a provider that can handle increased transaction volumes during peak seasons and as you expand to new locations or online.

- The Goal: Partner with a solution that supports your growth, not one that holds it back.

7. Customer Support

When something goes wrong at checkout, you need help immediately.

- Reliable, accessible, and knowledgeable customer support is critical. Look for providers who offer timely support channels.

- The Goal: Ensure any issues are resolved quickly to minimize sales disruption.

8. Reliability

Uptime is everything in retail. A system outage means lost sales.

- Investigate the provider’s historical uptime performance and system stability. Consistent reliability is a key trait of the best identity verification software.

- The Goal: Have unwavering confidence that your verification system will work every time, all the time.

ID.me Alternatives

Several identity verification platforms serve as alternatives to ID.me, including the following:

FTx Identity

FTx Identity is our age and identity verification solution. Our primary emphasis is on retail operations, particularly in collaboration with tobacco retailers and stores selling age-restricted products.

What sets us apart is:

- Our exclusive in-house integration.

- No third-party companies

- Effortlessly track and manage your age verification processes

- User-friendly analytics in the back office

Proxi.id

Specializing in online user verification services, this company provides solutions for confirming the academic standing of students and faculty, verifying the active-duty status of military personnel, and validating the employment status of government and non-profit workers. Its primary focus lies within the e-commerce sector, delivering services to merchants aiming to connect with targeted groups and bolster fraud prevention measures.

Trust Stamp

Offering AI-powered identity services, Trust Stamp specializes in developing a comprehensive suite of tools encompassing identity verification, duplicate detection, document validation, privacy, and data protection. Its clientele spans various sectors, including banking, finance, government, regulatory compliance, real estate, communications, and the humanitarian industry.

Jumio

Specializing in identity verification solutions, Jumio operates at the intersection of technology and cybersecurity. Its primary clientele includes sectors such as healthcare, financial services, online gaming, and the sharing economy. Jumio provides services enabling organizations to verify identities and detect fraud throughout the customer lifecycle, leveraging AI and machine learning to offer predictive fraud insights and risk analysis.

Wrapping Up

Exploring the world of online identity verification, we’ve traced the path of ID.me, from its evolution to the controversies and alternatives it faced. From its roots in the military to the IRS turbulence, ID.me’s challenges highlight the need for reliable alternatives. FTx Identity, Proxi.id, Trust Stamp, and Jumio emerge as strong options, promising a future where security and user experience come together in the digital identity space.

Stop Losing Sales to Slow Verification

Transparent pricing. Instant approvals. Full POS integration. No third-party data risks. Everything your store needs to verify customers with confidence.