You’ve launched an affiliate marketing program, and you’re ready for the website traffic and conversions to funnel in.

But you face a problem:

Your website is seeing a big increase in traffic, but few conversions. In fact, most of your new leads are bogus. You’re scratching your head at dwindling margins. What could be going wrong?

Check for affiliate fraud. This increasingly common type of fraud targets affiliate campaigns with bot traffic, fake clicks, and improperly attributed leads. The impacts: Bots now account for up to 24% of mobile traffic in affiliate campaigns (TrafficGuard). In 2022, according to CHEQ, fraudulent activity in affiliate marketing was estimated to cost businesses up to $3.4 billion, driven by fake clicks, bots, and invalid conversions.

Here’s the good news: New tools are available that can help businesses detect affiliate fraud. Behavioral analytics, ID verification, and anomaly detection, to name a few, are must-haves for preventing fraud in your affiliate campaigns.

But first, to prevent affiliate fraud, you must recognize the warning signs. If you need some help, this guide provides an in-depth overview:

- What affiliate fraud is

- How affiliate fraud harms your business

- Common affiliate fraud techniques

- Tools and strategies to stop affiliate fraud

What Is Affiliate Fraud?

Affiliate fraud affects affiliate marketing campaigns

Affiliate marketing is a performance-based marketing strategy. An affiliate for your business earns a commission for promoting your products or services. For example, a YouTuber might feature your products and earn a referral fee if their recommendation turns into a purchase.

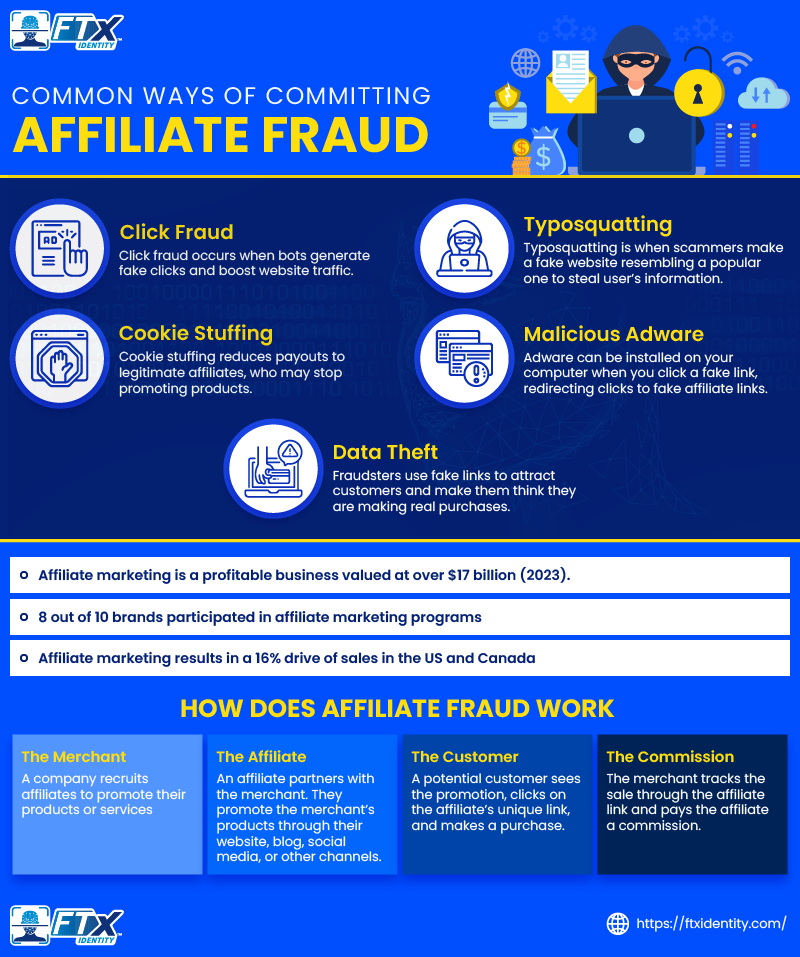

Here’s how it works:

1. The Merchant: A company recruits affiliates to promote their products or services.

2. The Affiliate: An affiliate partners with the merchant. They promote the merchant’s products through their website, blog, social media, or other channels.

3. The Customer: A potential customer sees the promotion, clicks on the affiliate’s unique link, and makes a purchase.

4. The Commission: The merchant tracks the sale through the affiliate link and pays the affiliate a commission.

Why Affiliate Fraud Happens

Affiliate programs weren’t built with fraud in mind. They were built for reach, incentives, and scalability. That’s exactly what makes them vulnerable. When rewards depend on conversions or traffic, fraudsters treat your program like an ATM that’s missing half its security features.

Flawed Reward/Commission Structure or Weak Controls

A poorly designed commission model is an open invitation for abuse. Pay-per-click and pay-per-lead structures are especially tempting because affiliate fraudsters can inflate numbers without generating a single real customer. When the reward doesn’t tightly correlate with genuine value, affiliate marketing scams flourish.

Lenient Affiliate Onboarding

If your onboarding process is a little more than “enter your email and create a username,” you’re not onboarding affiliates – you’re onboarding bots, fake marketers, and multi-account creators. Weak vetting is one of the core drivers behind affiliate program fraud because it allows fraud networks to quietly multiply.

Lack of Monitoring, Analytics, and Oversight

Fraud fills the gaps where no one is watching. Programs that operate on outdated dashboards, delayed reporting, or manual checks often miss the subtle patterns: repeated internet protocol (IP) addresses, identical browsing behaviors, sudden traffic spikes, and impossible conversion times. Without granular analytics, you’re not managing affiliates; you’re hoping they’re honest.

Advances in Fraud Tools & Techniques

Fraudsters aren’t sitting in basements clicking links. They use:

- Bot farms

- Device emulators

- Rotating proxies

- Adware injections

- Spoofed fingerprints

Modern tools make affiliate marketing fake activity almost indistinguishable from real users –unless you’re using the right detection stack.

Pressure to Scale & Acquire Users

Companies often prioritize fast growth over clean growth. That push to scale quickly leads to shortcuts: approving affiliates without checks, increasing commissions, relaxing oversight, and assuming that volume automatically means value. Fraud thrives in these shortcuts.

High Commissions

Any program offering high payouts becomes a magnet for abuse. The bigger the reward, the more creative fraudsters become. If you don’t prevent affiliate abuse early, the money you spend on commissions will burn faster than your ad budget.

Anonymizers (VPNs, Proxy Servers)

Legitimate users might use virtual private networks (VPNs), but fraudsters rely on them. IP masking, device spoofing, and location obfuscation make detection harder and allow the same attacker to appear as hundreds of “new users.”

When It Turns to Affiliate Fraud

Affiliate marketing turns to fraud when bad actors try to manipulate the affiliate commission system.

Some of the most common ways affiliate fraud is committed include:

1. Click Fraud

Some affiliate campaigns pay a commission for traffic. The more traffic an affiliate marketer drives to the campaign, the more the commission.

Click fraud occurs when automated programs (bots) are used to generate fake clicks and inflate website traffic.

2. Typosquatting

Typosquatting happens when a fraudster builds a lookalike website for a popular domain. And uses a similar, albeit misspelled or deceptive, URL.

With this type of affiliate fraud, the fraudsters’ aim is to steal commissions or commit data theft through phishing.

3. Cookie Stuffing

Cookies are used to track affiliate commissions. However, fraudsters can inject fake affiliate cookies on an affiliate’s website to hijack commissions.

For businesses, cookie stuffing reduces your payouts to legitimate affiliates. If there is a serious problem, affiliates may stop promoting your products.

4. Malicious Adware

Adware can become installed on your computer after clicking a fraudulent link. This malware then redirects clicks to fraudulent affiliate links.

The goal is to steal commissions from legitimate affiliates.

5. Data Theft

Data theft is often the goal of affiliate fraud. A fraudster may use illegitimate links to drive traffic and get customers to make “purchases.” Ultimately, these scams look like a deal for your business, but really, it’s just a masked website used to steal customers’ credit card data and use it in card-not-present (CNP) fraud.

As a business owner, affiliate fraud can have a real impact on your marketing efforts. You’ll notice diminishing or negative ROI in your marketing campaigns, for one. But also, your business will experience a loss in productivity as they deal with sorting out fraudulent leads.

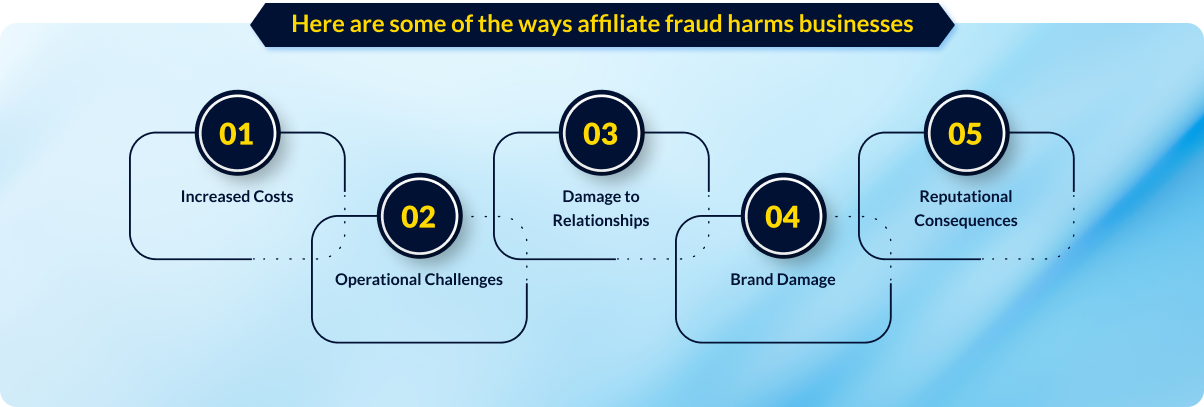

Here are some of the ways affiliate fraud harms businesses:

1. Increased Costs

Affiliate fraud affects businesses financially in three ways:

It diminishes revenue, as your marketing budget stops turning into sales.

Second, your advertising costs will increase.

Finally, you’ll spend more as you chase lost profits and investigate fraud.

Costs can skyrocket if affiliate fraud isn’t mitigated.

2. Operational Challenges

Affiliate fraud makes it difficult to measure your marketing campaigns. Fake clicks and fraudulent conversions distort your data, leaving you navigating in the dark. And this often results in lost productivity from account and campaign managers.

3. Damage to Relationships

Successful campaigns rely on the power of legitimate affiliates. When fraud goes unchecked, it can breed suspicion among your affiliate partners. This can damage relationships and hinder the program’s growth.

You can also damage your business’s reputation with customers. If fraudulent activity results in poor customer experiences (e.g., fake products, spammy ads), it can damage your brand reputation and erode customer trust.

4. Brand Damage

Customers who fall victim to fraudulent affiliate activity are likely to share their negative experiences online, damaging your brand image and reputation.

Once trust is broken, it’s hard to win back. Fraudulent activity can lead to lost customers and a decline in brand loyalty.

5. Reputational Consequences

Affiliate fraud can attract unwanted media attention and further damage your reputation. In rare cases, fraudulent activity within your affiliate program can lead to legal repercussions, adding another layer of stress and complexity.

Affiliate Fraud Detection Techniques

Affiliate fraud is not just a nuisance; it’s a serious threat to your business’s financial health, operational efficiency, and brand reputation.

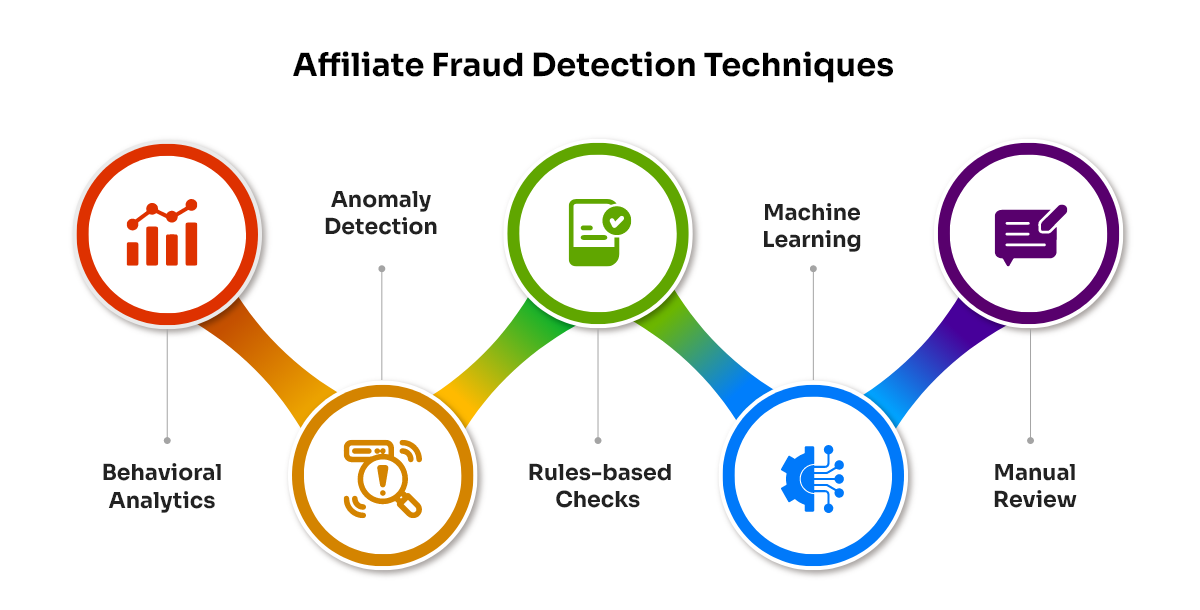

Vigilance is your best weapon in the fight against digital deception. Here are some tools you can use to prevent affiliate fraud:

1. Behavioral Analytics

A behavioral analytics tool monitors click velocity (from affiliates) and checks for IP address clustering and geolocation mismatches. For example, if several conversions/clicks originate from the same IP address, this may be a fraud signal.

2. Anomaly Detection

These tools monitor for unusual traffic and conversion patterns. A sudden spike in traffic or an unusually high or low conversion rate can be detected.

3. Rules-based Checks

These would be manually adjusted checks. For example, you might blacklist devices, prohibit traffic sources, or flag affiliate links with unusual formatting or embedded code.

4. Machine Learning

AI tools can be used for fraud scoring or to develop predictive models. You can use these tools to set a risk score for every affiliate candidate, for example.

5. Manual Review

You should offer a closed affiliate program and manually verify the legitimacy of each affiliate candidate.

Strategies to Prevent Affiliate Fraud

In addition to fraud detection tools, these proactive measures can help you safeguard your affiliate program:

1. Choose Reliable Affiliate Networks

Don’t just open your doors to any passerby. Partner with established affiliate networks renowned for stringent vetting processes and rigorous monitoring systems. These gatekeepers weed out bad actors before they can infiltrate your program.

2. Monitor Affiliate Activities

Vigilance is key. Regularly scan affiliate activity for anomalies. Be wary of:

- Sudden spikes in traffic

- Suspiciously high conversion rates from unknown sources

- Unusual geographic patterns.

Invest in robust fraud detection tools that analyze clickstream data and flag irregularities.

3. Set Up Clear Terms and Conditions

Leave no room for ambiguity. Craft comprehensive terms and conditions that explicitly outline acceptable and unacceptable affiliate practices. In your guidelines, provide clear definitions for:

- Click fraud

- Cookie stuffing

- Other illicit tactics

- Penalties for violations

This clear-cut contract sets expectations and empowers you to take decisive action against rule-breakers.

4. Use Multiple Data Sources

Relying on single-source data creates blind spots. Employ a multi-layered approach by integrating data from different platforms, including your website analytics, affiliate network reports, and payment processors.

This cross-validation helps identify discrepancies and exposes hidden fraudulent activity that might otherwise slip through the cracks.

5. Educate Your Affiliates

Empower your affiliates to be your partners in crime-fighting. Regularly educate them about the various forms of affiliate fraud, sharing detection tips and best practices. This collaborative approach fosters transparency and enables everyone to contribute.

Advanced & Emerging Threats

Fraud has evolved from low-effort trickery to coordinated, multi-layered operations that operate at scale.

Collusion & Multi-Account / Network Fraud

Some groups create networks of related accounts that funnel traffic and conversions between each other. On the surface, it looks like multiple independent affiliates until you zoom in and notice shared devices, identical timing, and synchronized behavior.

Proxy/VPN & Device-Fingerprinting Evasion

Device farms use virtual machines, altered fingerprints, and rotating IPs to look like thousands of unique devices. This blends fake activity with real behavior, making it harder to detect without deeper identity signals.

False Positives & Over-Reliance on Automation

Automated systems can be fooled, and they can also misclassify genuine affiliates as fraud risks. Overly rigid rules may block valuable partnerships, while sophisticated fraud slips through. Effective affiliate fraud prevention solutions are built with adaptability, not just rigidity.

Hybrid Fraud: Mixed Real + Fake Behavior

This is one of the hardest attack patterns to spot. Fraudsters mix real traffic with fake clicks, real leads with synthetic conversions, and genuine users with bot-generated activity. It’s fraud by dilution.

Cross-Channel & Cross-Platform Complexity

One affiliate may operate across social media, search, mobile apps, email, and partner sites. Fraud follows the same pattern. Tracking that web requires integrated analytics, something many programs still lack.

Regulatory / Data-Privacy & Compliance Risk

The General Data Protection Regulation (GDPR), California Consumer Privacy Act (CCPA), and other privacy laws dictate how user data can be collected, tracked, and analyzed. Tracking methods like fingerprinting may be legally restricted. That means your fraud strategy must remain effective even under compliance pressure.

Checklist: How to Audit & Harden Your Affiliate Program

This is the actionable part; the step-by-step you’d follow if you were rebuilding your program with fraud prevention at the core.

Program Structure & Policy Audit

Review how incentives are structured. If rewards don’t align with actual value, fraud will exploit the gap. Tighten conditions around payout, conversion rules, and acceptable behaviors.

Affiliate Vetting & Onboarding Controls

Move from “open to everyone” to “open to the right ones.” Screen affiliates with basic identity validation, traffic verification, background checks, and manual review where needed.

Traffic Quality & Compliance Checks

Audit where their traffic comes from. If you find bot-like patterns or inconsistent sources, reconsider the partnership. Use automated systems to detect anomalies without punishing legitimate affiliates.

Conversion Integrity & Fraud Detection

Match conversions with session data, device signals, and behavior patterns. If you can’t link a conversion to real user intent, question it.

Compliance With Legal & Platform Requirements

Ensure your tracking approach adheres to platform rules and privacy laws. Incorrect tracking doesn’t just weaken fraud detection; it creates compliance liability.

Payment Accuracy & Payout Risk Controls

Double-check every commission before payout. Fraudsters rely on programs that don’t audit their own math.

Technical Security & Tracking Integrity

Software development kit (SDK) tampering, cookie stuffing, and postback manipulation – these are very real threats. Validate your tracking endpoints and monitor irregular patterns.

Ongoing Monitoring & Optimization

Fraud prevention isn’t a one-time fix. Update rules, analyze trends, compare cohorts, and regularly refresh your fraud detection logic.

Use Anti-Fraud Tools

Modern integrates:

- Device intelligence

- Behavioral analytics

- IP risk data

- Machine learning models

These tools help you identify fraud patterns that humans simply can’t see.

Build a Stronger Affiliate Identification Program with FTx Identity

Combating affiliate fraud isn’t a sprint; it’s a marathon. First, educate yourself in how to recognize it and train your staff. Then, start implementing tools and strategies to prevent it.

Focus on continuous development. For example, you might first implement a behavioral analytics tool before moving on to ID-based verifications for onboarding new affiliates. Ultimately, though, if you build a comprehensive process, you’ll save yourself time and resources.

Need some help knowing who your affiliates are? FTx Identity helps online businesses build robust identity verification protocols. Contact us today to learn more.

See How FTx Identity Can Protect Your Program

Stop fraud before it impacts your campaigns. Connect with us today to schedule a consultation and demo, and discover how FTx Identity keeps your affiliate program safe, reliable, and effective.