Businesses face a growing and expensive problem in the busy world of ecommerce: first-party fraud (FPF).

Also commonly referred to as “friendly fraud” or “chargeback abuse,” this happens when customers make real purchases but later dispute the charges to get refunds or free items. As online shopping grows, the cost of first-party fraud to businesses has increased, making it an urgent issue that needs effective solutions.

One promising tool to combat first-party fraud is digital identity verification. Solutions like FTx Identity help retailers accurately verify customers, reducing fraud and protecting revenue.

This blog post explores the workings of first-party fraud and explains how digital ID verification can significantly benefit ecommerce businesses.

What Is First-Party Fraud? A Hidden Threat in Ecommerce

First-party fraud occurs when customers deliberately exploit policies and systems for personal gain. Unlike fraud that involves stolen credit cards or identity theft, this type is committed by the actual account holders, making it harder to detect and prevent.

A common example of first-party fraud is “friendly fraud.” In these cases, customers dispute legitimate charges on their credit card bills, claiming they never made the purchase. While friendly fraud can sometimes be unintentional due to forgetfulness or misunderstanding, it still has major financial impacts on retailers.

The result? Financial institutions and merchants in the U.S. face over $100 billion in losses annually.

How Does First Party Fraud Work?

First party fraud happens when an individual intentionally provides false information or misled their identity to benefit from finances, items, or exchange of goods.

First party fraud example in banking could involve an individual applying for a loan or a credit card before ultimately defaulting on the repayment.

Another most observed first party fraud is when a consumer obtains goods or services from a merchant (usually online) and then claims they did not make the purchase or receive the goods to claim a false refund for the items.

Types of First-Party Fraud

First-party fraud can appear in several forms, such as:

- Chargeback Abuse (Friendly Fraud): Customers sometimes report unauthorized transactions to get refunds, even after receiving the goods or services. This can create major issues for businesses because they have to deal with financial loss, manage customer relations, and make sure that their systems are secure to prevent future fraudulent claims.

- Return Fraud: Practices like “wardrobing,” where customers buy items, use them, and then return them for a full refund, are becoming more common. This behavior can be especially prevalent during special events, like weddings, where individuals want to look their best without dealing with the full cost of the clothing. Retailers are increasingly aware of this trend and are implementing measures to combat it, such as stricter return policies and enhanced tracking systems.

- Gift Card Fraud: Scammers often use stolen credit cards to purchase gift cards, which are then easily resold or used for personal gain. Additionally, they may falsely claim that they never received the gift cards they bought, attempting to get a refund or replacement. This type of fraud can be particularly difficult to track and resolve, causing significant financial losses.

- Lost in Transit Fraud: This type of fraud occurs when customers claim they never received their order, even though tracking information shows it was delivered. However, the thing is that they have received the product but are attempting to get a refund or replacement by falsely reporting it as lost.

- Item Not as Ordered Fraud: This type of fraud occurs when customers falsely claim they received the wrong or damaged item to get a replacement or a refund. Most of the time, they may provide fabricated evidence or exaggerated descriptions to support their claims.

- Ghost Funding: Fake accounts are created to manipulate payment systems or exploit promotions. These accounts can make unauthorized transactions and misuse discounts meant for real users.

Why Solving First-Party Fraud Is So Difficult

Identifying and preventing first-party fraud is challenging. It’s tough to distinguish between honest mistakes and intentional abuse. For example, a customer might genuinely forget about a purchase and dispute it, or they could be using this confusion to commit fraud without legal consequences.

Imagine an online retailer selling high-end electronics. A customer buys a laptop but later disputes the charge, claiming they never received it. The retailer now must prove the delivery while managing the financial burden of the chargeback, which is often lengthy and costly.

How Weak Verification in Ecommerce Enables FPF

First-party fraud isn’t just a financial issue; it’s a trust issue. Businesses must invest in technology that prioritizes both security and customer satisfaction.

Weak verification systems in ecommerce open the door for fraudulent activities such as:

- Insufficient identity verification during account creation allows for fake accounts.

- Lack of strong transaction monitoring allows suspicious activities to be overlooked.

- Weak return policies allow fraudsters to easily commit return fraud.

- Inadequate delivery confirmation processes lead to lost-in-transit fraud claims.

The need for stronger customer verification methods is urgent, and digital age verification offers a promising solution.

The Solution: Digital Age Verification

FTx Identity provides a complete solution to fight first-party fraud with digital age verification.

It uses advanced technology to confirm customer identities, ensuring only genuine customers can make purchases and initiate chargebacks. This boosts security and builds trust with your customers. Additionally, FTx Identity helps businesses meet regulatory requirements, reducing legal risks and protecting against fraud.

However, digital ID verification is just one layer of defense against first-party fraud. A strong anti-fraud strategy often requires more steps (more on that later).

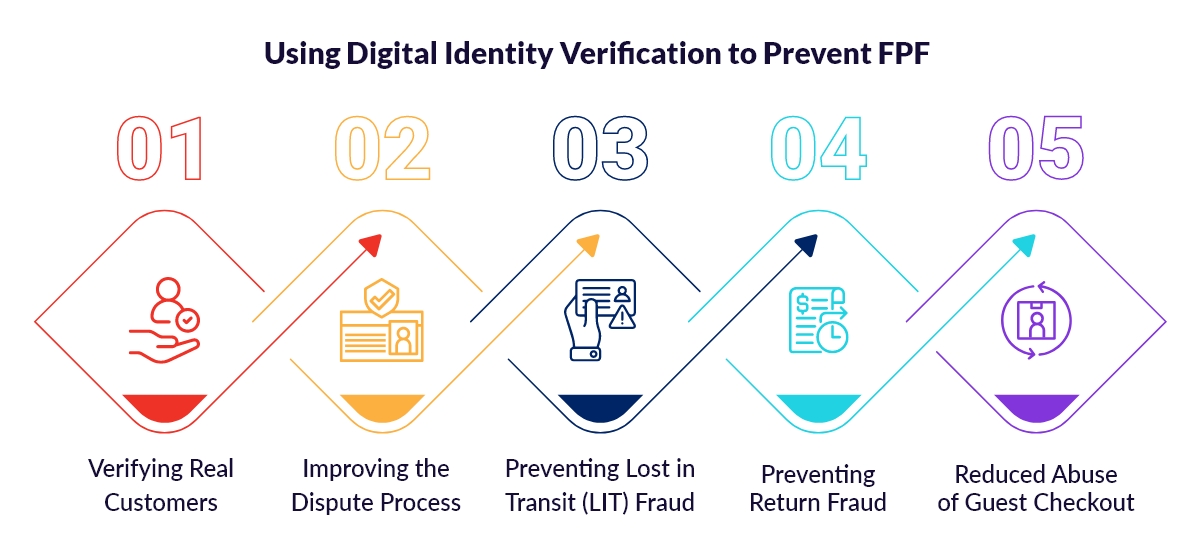

Using Digital Identity Verification to Prevent FPF

Digital age verification provides several benefits for first-party fraud prevention:

1. Verifying Real Customers

When an ecommerce transaction is performed, a customer is usually not physically present. The result? It makes it much more challenging to verify their identity. Luckily, facial recognition and selfie checks can help solve this issue.

- Liveness Detection: The customer takes a selfie during the checkout process. Facial recognition software with liveness detection makes sure it’s an actual person, not a photo or mask. This helps stop fraud with stolen credit cards or identities.

- Account Match Verification: The selfie can be compared to a government ID photo that’s already been submitted. This ensures that the person making the purchase is the authorized account holder, reducing the risk of fraudulent transactions using compromised accounts.

2. Improving the Dispute Process

In disputed charge cases, strong ID verification shows that the cardholder authorized the purchase, which can help merchants win chargeback disputes.

- Strengthens Identity Proof: A verified ID shows clear proof that the cardholder approved the purchase. This helps the merchant in disputes where the cardholder denies making the purchase.

- Reduces Unnecessary Chargebacks: The extra verification step discourages some customers from filing unnecessary chargebacks because they know the merchant has proof of their authorization.

- Gives Content for Disputes: Verified user information can help pinpoint reasons for disputes, enabling quicker resolution. For example, a difference between the billing and shipping addresses might explain a customer’s confusion.

- Prevents Fake Accounts: ID verification makes it harder to create fake accounts, reducing disputes from fraudulent accounts.

Over $100 billion is lost annually to first-party fraud in the U.S., significantly impacting businesses and financial institutions.

3. Preventing Lost in Transit (LIT) Fraud

ID verification can help tackle LIT fraud as part of a bigger strategy:

- Account History: By combining ID verification with historical data, merchants can identify users with a history of LIT claims. These accounts can then be flagged for further scrutiny or required to follow stricter return procedures.

- Linked Information: Linking accounts to phone numbers or addresses through verification processes makes it harder for fraudsters to create multiple accounts for fraudulent purposes.

- Deterrence: A strong verification system can create a sense of heightened security, deterring some potential fraudsters from attempting LIT scams.

4. Preventing Return Fraud

Here’s how ID verification can help fight return fraud:

- Account History: By verifying users when they create an account or make a purchase, merchants can track past returns affiliated with that identity. Customers with many suspicious returns can be flagged for review or stricter return policies.

- Deterrence: A strong verification system can deter fraudulent returns. Fraudsters may avoid making returns if they know their identity is tracked.

5. Reduced Abuse of Guest Checkout

Some customers use guest checkout options to bypass return restrictions linked to accounts. ID verification can encourage account creation, making it easier to track return history.

- Verification can also enable “returnless refunds” for certain items. For example, verifying a customer’s identity for a defective or damaged product could allow a refund without needing the physical return of the item, reducing the chance of fraud.

Other Tools for Preventing First-Party Fraud

Other than digital age verification, there are other tools and techniques businesses can use to prevent first-party fraud, including the following:

- Behavior Biometrics: Authenticates users using their unique behavior patterns, such as typing speed, mouse movements, and touchscreen interactions.

- Risk Scoring: Assigns risk scores to transactions based on various factors, including transaction amount, user location, and purchase history, to identify potentially fraudulent activity.

- Digital Asset Verification: Validates digital assets, such as gift cards and coupons, ensuring they are legitimate and have not been tampered with or duplicated.

- Delivery Confirmation: Confirms that customers receive their orders by tracking shipment status and obtaining delivery receipts, helping to improve customer satisfaction and trust.

- Transaction Monitoring: Continuously checks transactions for signs of fraud by analyzing real-time data and flagging suspicious activities for further investigation, therefore enhancing security and reducing financial losses.

Conclusion

Fighting first-party fraud is essential for protecting the financial health and reputation of ecommerce businesses. Using strong verification methods, such as digital age verification solutions like FTx Identity, businesses can greatly lower the risk of fraud, improve their dispute processes, and protect their revenue.