Cryptocurrency, once a niche market, has grown into a global financial phenomenon. With its expansion, the need for security and regulatory compliance has become increasingly important.

One of the foundations of this compliance is Know Your Customer (KYC) procedures.

What’s the significance of optimizing Know Your Customer (KYC) procedures within the cryptocurrency realm? This guide highlights the role played by ID technology in simplifying and enhancing this process. Additionally, we will provide valuable insights into practical strategies businesses can use to successfully integrate and execute KYC protocols, ensuring efficiency and compliance.

Understanding KYC for Crypto

KYC verification in crypto is particularly vital in combating money laundering, terrorist financing, and other illicit activities. To achieve this, crypto KYC requirements typically involve users providing:

- Personal Data: Essential details such as their full legal name and residential address.

- Government-Issued Identification: Official documents like passports or driver’s licenses to confirm their identity.

- Proof of Address: Supporting documents such as utility bills or bank statements to verify their stated address.

- Biometric Verification: Techniques like selfie or video verification to match the user to their submitted identification, ensuring they are the rightful owner.

The Challenges of Cryptocurrency Exchange Compliance

For cryptocurrency exchanges, staying compliant with ever-evolving regulations is a continuous challenge. Failure to do so can result in legal penalties and harm to their reputation. Therefore, crypto exchange operators must establish stringent KYC requirements for cryptocurrency users.

One ongoing problem in the industry is the presence of crypto exchanges that don’t require users to prove who they are before trading. While these platforms may attract users seeking anonymity, they often face regulatory scrutiny and potential legal consequences.

Why Crypto Businesses Can’t Afford to Skip KYC Verification

The days of crypto’s wild west are over. Anyone still clinging to the notion that regulatory oversight is a distant threat is playing a dangerous game for their business’s future.

Let’s be serious: Skipping KYC is not an option to consider. The regulatory bodies aren’t playing games anymore. They’re demanding accountability, transparency, and a demonstrable commitment to preventing illicit activities. And frankly, they’re right.

As highlighted by SEON, a robust KYC framework is essential to increase customer trust. They understand that trust isn’t built on empty promises; it’s forged through verifiable actions.

And Trulioo drives home the point with a stark reality: Trulioo emphasizes the importance of digital identity verification in meeting KYC/AML requirements, especially within the cryptocurrency sector. They specifically highlight the need for accurate customer onboarding and ongoing monitoring to mitigate risk.

Your reputation is your currency in the crypto world. A single regulatory misstep, a single instance of being linked to illicit activity, can obliterate years of hard-earned trust. And in a space where news travels at the speed of light, that damage is often irreparable.

In essence, skipping KYC isn’t a risk; it’s a self-inflicted wound. It’s a gamble with your reputation, your legal standing, and ultimately, your business’s very existence. The message is clear: embrace KYC, or prepare to face the consequences.

Leveraging ID Technology for Efficient Crypto KYC

Efficiency in KYC procedures is critical for both businesses and users. Leveraging ID technology can significantly enhance the user experience while ensuring compliance.

Here’s how businesses can benefit from implementing ID technology in their crypto KYC processes:

Automation and Speed

Efficiency in KYC procedures is crucial for both businesses and users. By implementing ID technology, businesses can automate the KYC verification crypto process.

This allows users to complete identity verification swiftly, reducing waiting times for account approval.

Automating the process not only makes it faster but also reduces the chance of human mistakes in manual checks, making the user experience better. The allure of quick digital onboarding can attract more users to the platform, enhancing its growth and competitiveness.

Enhanced Security

Security is paramount in the world of cryptocurrency, and ID technology plays a pivotal role. By using advanced methods like document verification and using biometrics (like fingerprints or facial recognition), ID technology makes sure that the information users provide is accurate and reliable.

This enhanced security reduces the risk of fraudulent activities, maintains the platform’s integrity, and enhances overall user confidence. Businesses can safeguard against counterfeit documents and unauthorized access, providing a secure environment for cryptocurrency transactions.

Scalability

As the cryptocurrency market continues to expand, businesses need to adapt and accommodate a larger user base efficiently. ID technology simplifies this process by enabling seamless scaling of KYC procedures.

In a fast-growing market, businesses can manage more verifications efficiently without sacrificing the security or compliance of their platform.

Additionally, ID technology facilitates compliance with evolving regulatory standards, ensuring that KYC procedures remain up-to-date and aligned with industry best practices.

User Convenience

Providing a user-friendly experience is paramount for cryptocurrency platforms. Efficient KYC procedures significantly contribute to the overall user experience. Users appreciate platforms that offer streamlined onboarding processes, as they can quickly complete the KYC process.

The quicker and smoother onboarding is, the more likely users are to engage with the platform. This leads to increased customer satisfaction and loyalty, ultimately making platforms more competitive in the cryptocurrency industry. Platforms that prioritize user convenience stand out as user-friendly and trustworthy, further enhancing their reputation in the crypto ecosystem.

KYC Requirements for Cryptocurrency Businesses

While specific KYC requirements for this type of business may vary based on jurisdiction and regulatory changes, certain common elements exist.

Here are aspects businesses should consider:

Identity Verification

Cryptocurrency businesses typically require users to provide government-issued identification like passports or driver’s licenses. This data is crucial for confirming the user’s identity and complying with regulations. ID technology is crucial in this process as it swiftly and accurately confirms the legitimacy of these documents, reducing the need for manual work and boosting security.

Proof of Address

Proof of address documents, such as utility bills or bank statements, serve to confirm a user’s residence. This helps prevent fraudulent activity and ensures compliance. ID technology expedites this process by swiftly proofing these documents, reducing delays in the onboarding process.

Enhanced Due Diligence

For high-risk transactions or substantial fund transfers, enhanced due diligence is necessary. This may involve additional identity checks and verification of the source of funds. ID technology can automate these processes, ensuring comprehensive due diligence while maintaining efficiency.

Ongoing Monitoring

Cryptocurrency businesses must implement continuous monitoring to detect suspicious activities and adhere to evolving regulations. ID technology can help in this by continuously analyzing user behavior and transaction patterns, promptly flagging any anomalies, and ensuring ongoing compliance with regulatory changes.

Can You Do a Crypto Exchange Without KYC?

Yes, trading crypto without KYC is possible, but it depends on the platform you choose. Some cryptocurrency exchanges do not require users to undergo identity verification and allow for anonymous trading. However, as mentioned, such non-KYC crypto exchanges often face regulatory scrutiny and may impose limitations on the amount and type of transactions users can conduct.

How KYC Works in Crypto

KYC in cryptocurrency works similarly to traditional financial ID verification methods. Users provide personal information and documentation to verify their identity. This information is cross-referenced with various databases to ensure its accuracy. ID technology plays a pivotal role in simplifying this process by automating document verification and reducing the time required for KYC checks.

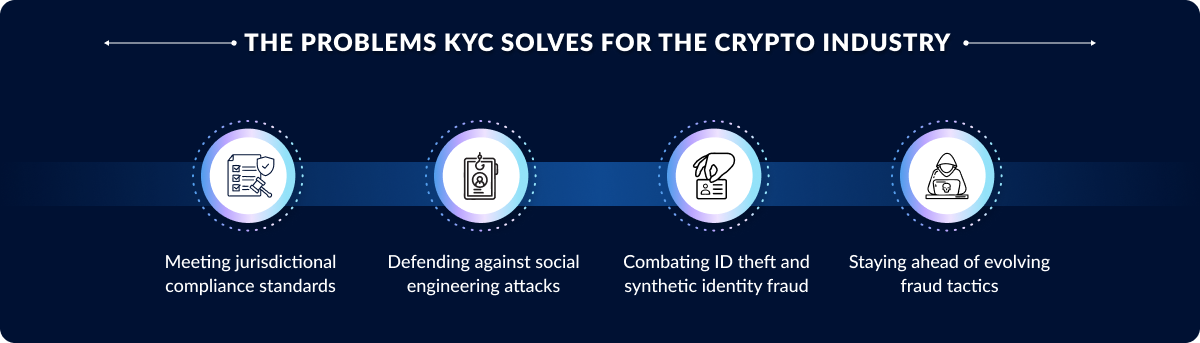

The Problems KYC Solves for the Crypto Industry

The crypto industry, while brimming with innovation, faces a unique set of challenges that necessitate robust KYC measures. It’s not just about ticking boxes; it’s about building a foundation of trust and security in a space still grappling with its identity.

Meeting Jurisdictional Compliance Standards:

- Navigating the labyrinth of global regulations is a herculean task. KYC regulations crypto vary wildly, demanding a flexible and adaptable approach.

Defending Against Social Engineering Attacks:

- The digital nature of crypto makes it a prime target for social engineering. From phishing scams to impersonation, the risks are real. Crypto identity verification is the first line of defense, ensuring that users are who they claim to be, mitigating the damage caused by these manipulative tactics.

Combating ID Theft and Synthetic Identity Fraud:

- The anonymity that once defined crypto is now a double-edged sword. Criminals exploit this, creating synthetic identities or stealing real ones to facilitate illicit activities. A comprehensive identity verification for cryptocurrency systems, therefore, is essential to halt these practices.

Staying Ahead of Evolving Fraud Tactics:

- Fraudsters are relentless, constantly evolving their tactics. To stay ahead, crypto businesses need dynamic solutions. This involves continuous monitoring and adaptation to new threats, ensuring the platform remains secure.

Benefits of Crypto KYC

Implementing crypto KYC procedures offers numerous benefits to both businesses and users:

Enhanced Security

Implementing crypto KYC procedures significantly bolsters the security of cryptocurrency platforms. These procedures act as a robust defense mechanism against unauthorized access and potentially fraudulent activities.

By verifying user identities through KYC, platforms ensure that only legitimate individuals have access to their accounts. This, in turn, reduces the risk of fraud and theft, creating a safer environment for users to engage in cryptocurrency transactions with confidence.

Regulatory Compliance

Cryptocurrency businesses must adhere to KYC requirements to remain compliant with evolving regulations. Failure to do so can lead to severe legal consequences, including hefty fines and potential shutdowns.

Following KYC rules is not merely a choice but a necessity in order to keep the cryptocurrency world safe and trustworthy. It also fosters a regulatory environment where cryptocurrencies can coexist with traditional financial systems, facilitating their broader adoption and acceptance.

Trust and Credibility

Trust is paramount in the cryptocurrency industry, and businesses that prioritize KYC procedures gain a substantial advantage in this regard. Users are more likely to trust and engage with platforms that demonstrate a commitment to trustworthiness and transparency through strict KYC measures.

This trust-building process enhances customer loyalty, contributing to the long-term success and sustainability of cryptocurrency businesses. Ultimately, it positions these businesses as reliable and credible participants in the competitive crypto landscape.

Reduced Risk

KYC procedures serve as a crucial risk mitigation strategy for cryptocurrency platforms. By verifying user identities, businesses can effectively minimize the risk of money laundering, fraud, and other illicit activities on their platforms.

These procedures act as a deterrent, making it significantly more challenging for malicious actors to engage in illegal activities within the cryptocurrency realm.

Consequently, KYC not only safeguards the platform but also protects the interests of all users and investors, contributing to a safer and more trustworthy crypto environment.

Essential Tools and Features for Effective Crypto KYC

Effective KYC in crypto demands a sophisticated toolkit. It’s not enough to simply ask for an ID; modern solutions need to delve deeper.

ID Selfie and Liveness Verification:

- These technologies go beyond simple ID checks. They ensure the person is physically present, preventing spoofing and deepfake attacks. This is a critical component of secure crypto verification.

Digital Footprint Analysis:

- Analyzing a user’s digital footprint provides valuable insights into their behavior and legitimacy. Anomalies can signal fraudulent activity, strengthening the overall identity verification crypto process.

Device Intelligence:

- Understanding the device used for transactions is crucial. Device intelligence can detect suspicious patterns, such as multiple accounts using the same device or unusual device settings.

Blockchain ID Validation:

- Leveraging the immutability of the blockchain for ID validation adds an extra layer of security. This technology creates a tamper-proof record of user identities, enhancing trust and transparency. ID verification for cryptocurrency platforms can benefit greatly from this technology.

Significance of KYC for Crypto Exchanges

KYC is extremely important for crypto exchanges. It helps exchanges maintain regulatory compliance, prevent illegal activities, and build trust with users. Failing to implement effective KYC procedures can result in legal consequences and damage the exchange’s reputation, potentially leading to its shutdown.

Are There Crypto Exchanges Without KYC?

Yes, there are crypto exchanges that do not require KYC verification. These platforms cater to users who value anonymity and privacy in their cryptocurrency transactions. However, users should exercise caution when using non-KYC crypto exchanges, as they may face limitations on withdrawal amounts and could potentially encounter legal issues if the platform faces regulatory scrutiny.

Wrapping Up

Efficient cryptocurrency KYC procedures are essential for businesses operating in the crypto space. Leveraging ID scanning technology not only streamlines onboarding but also enhances security and ensures compliance with crypto exchange regulations.

As the crypto industry continues to evolve, businesses that prioritize efficient KYC procedures stand out as trustworthy and reliable platforms in the eyes of users and regulators alike. Implementing and optimizing KYC requirements for cryptocurrency is not just a regulatory necessity but a strategic advantage in the competitive world of cryptocurrency exchanges.

To sum it up, efficient KYC procedures are a win for both businesses and users, and they play a crucial role in preserving the cryptocurrency ecosystem’s integrity.

Don’t Let Compliance Slow You Down

Automate KYC, accelerate onboarding, and secure your

platform’s future with FTx Identity!