Picture this: Emily of Boston, Massachusetts, lost over $5,000 to a clever gift card scam. It started with a voicemail from someone posing as her internet provider, Xfinity, claiming her contract was expiring. The scammers, armed with her account details and credit card’s last four digits, sounded legit and convinced her to pay for a “promotion” using Target gift cards. Despite a few red flags, Emily went along – until a sharp-eyed CVS employee warned her. A quick call to Xfinity confirmed the ugly truth: the promotion was fake.

Emily’s Target gift card scam story is far too common.

In 2023, Americans lost a jaw-dropping $10 billion to scams – and a hefty $217 million of that came from gift card fraud, according to the Federal Trade Commission (FTC).

These scams don’t just affect consumers like Emily; they hit businesses just as hard. Store managers, customer service teams, and even small business owners can also be targets.

This guide is here to help you understand how gift card scams work, how to avoid them, and what to do if you or your business falls victim. Whether you’re a shopper, a family member, a store manager, or a business owner, there’s something here for you.

Table of Contents:

- What Are Gift Card Scams?

- How Do Gift Card Scams Work?

- Common Types of Gift Card Scams

- Brands and Cards Most Commonly Targeted

- Red Flags to Watch Out For

- How to Avoid Gift Card Scams

- What to do if You’ve Been Gift Card Scammed

- What Retailers Can Do to Help Prevent Gift Card Scams

Take control against fraud today! Explore FTx Identity to discover how our powerful security solutions can protect your business and customers. Schedule your consultation and demo now to get started!

What Are Gift Card Scams?

Gift card scams are a type of fraud where scammers trick people or businesses into buying gift cards and sharing the codes. Why gift cards? They’re convenient, have immediate value, and are hard to trace once redeemed, making them the perfect tool for criminals.

Here’s how scammers target each group:

For Consumers:

Scammers contact you by phone, email, or text. They use urgency and emotional manipulation, convincing you to purchase gift cards and send them the code. Once they have the code, they can sell or use the card instantly, and your money is gone.

For Businesses:

Businesses face unique risks. Fraudsters may impersonate HR, a company executive, or a vendor, tricking employees into buying gift cards for fake business needs. These scams can also occur at the point of sale (POS), where staff members are duped into activating fraudulent gift card transactions.

FTx Identity was created to help businesses combat the growing threat of fraud and scams. Its advanced verification tools strengthen security across digital and in-store channels, making it easier to protect both customers and operations.

Why Do Scammers Love Gift Cards?

- Instant value: Once scammers have the codes, the money is as good as cash.

- Hard to trace: Unlike credit card fraud, recovering funds from gift card scams is nearly impossible.

- Easy to resell: Scammers sell codes online at discounted prices, converting stolen gift cards into cash quickly.

How Gift Card Scams Work

Understanding the mechanics of these scams can help you spot them before it’s too late.

Here’s a step-by-step breakdown.

Consumer Version:

- You receive a call, text, or email claiming there’s an emergency or a special offer.

- The scammer convinces you to buy gift cards and insists that you act quickly.

- They ask for the codes on the gift cards or a photo of the scratched-off code area.

- Once they have the codes, the money is gone.

Business Version:

- An employee gets an email from someone pretending to be the CEO or HR.

- They are told to purchase gift cards for client gifts or another seemingly legitimate reason.

- Scammers use urgency to bypass normal purchase protocols.

- Once the gift cards are bought and the codes sent, the scam is complete.

A Side-by-Side Look

| Consumers | Businesses |

|---|---|

| Urgent call claiming you owe money | Email pretending to be from a trusted source |

| Told to buy specific gift cards | Employees asked to purchase gift cards |

| Codes are stolen and redeemed quickly | Codes are shared, leaving businesses with losses |

Common Types of Gift Card Scams

Here are some common scenarios to watch out for, broken down by audience.

For Consumers:

- Tech Support Scams: Fake tech support demands payment via gift cards.

- Romance Scams: Scammers pretend to be romantic partners needing financial help.

- Fake Prizes: A “winner” is instructed to pay fees using gift cards.

- Utility Bill Threats: You’re told your power will be shut off unless you pay by gift card.

- Marketplace Scams: Sellers demand payment in gift cards for nonexistent products.

For Businesses:

- CEO/HR Impersonation: Employees are asked to “urgently” buy cards for a project or client.

- Fake Vendor Payments: Scammers pose as vendors demanding gift card “payments.”

- Gift Card Refund Fraud: POS fraud where fake refunds are loaded onto gift cards.

- POS Fraud: Scammers trick staff into activating illegitimate transactions.

Brands and Cards Most Commonly Targeted

Not all gift cards are equal in the eyes of scammers. Fraudsters often go after popular brands with high resale value.

These include:

- Apple iTunes & App Store

- Target

- Google Play

- Amazon

- Walmart

- Steam (gaming)

- Vanilla Visa and American Express gift cards

If you’re asked to buy one of these, especially under pressure, think twice.

Red Flags to Watch Out For

One of the most effective ways to avoid scams is recognizing the gift card scam warning signs.

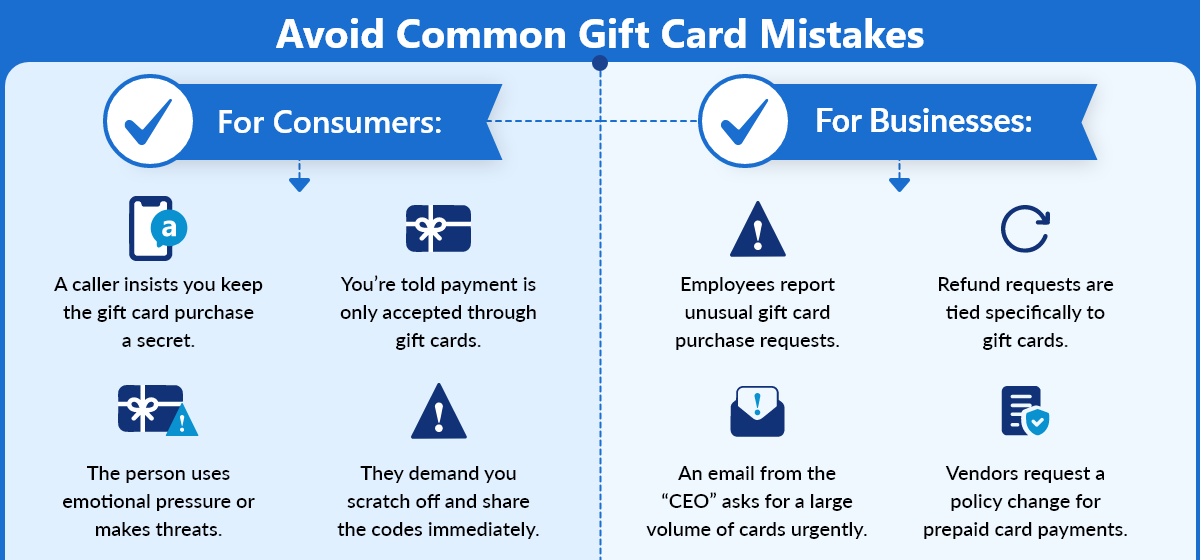

For Consumers:

- A caller insists you keep the gift card purchase a secret.

- You’re told payment is only accepted through gift cards.

- The person uses emotional pressure or makes threats.

- They demand you scratch off and share the codes immediately.

For Businesses:

- Employees report unusual gift card purchase requests.

- Refund requests are tied specifically to gift cards.

- An email from the “CEO” asks for a large volume of cards urgently.

- Vendors request a policy change for prepaid card payments.

How to Avoid Gift Card Scams

The good news is gift card scams can often be prevented with the right precautions.

For Consumers:

- Never share gift card codes over the phone, text, or email.

- Only buy cards from trusted retailers.

- Question any request asking for payment through gift cards.

For Businesses:

- Train your team to recognize phishing and Business Email Compromise (BEC) scams.

- Set limits on gift card purchases and require approvals.

- Use email validation tools to flag suspicious communications.

- Implement strict refund and activation policies for gift cards.

What to Do If You’ve Been Gift Card Scammed

Acting quickly can improve your chances of recovering funds.

Here’s what you should do:

For Consumers:

- Contact the card issuer immediately and report the fraud.

- File a report with the FTC, local police, or IC3.gov.

- Keep any evidence, like receipts or communications with the scammer.

For Businesses:

- Notify your finance, IT, and security teams immediately.

- Lock down compromised accounts and devices.

- Report the incident to the FTC and internal fraud teams.

- Review transaction logs to identify any patterns or additional risks.

Can You Get Your Money Back?

- For Consumers: Full recovery is rare, but contacting the card issuer quickly can sometimes help retrieve unused funds.

- For Businesses: Recovery depends on the internal fraud policy and the cooperation of vendors or banks.

What Retailers Can Do to Help Prevent Gift Card Scams

Businesses can take proactive steps to protect their operations from gift card fraud. Retailers have a vested interest in stopping gift card scams. Even if they aren’t directly responsible, customers often blame the store where the card was purchased. Victims may feel embarrassed, vulnerable, or angry — and that frustration can lead to lost trust and loyalty.Śv

By taking simple, proactive steps, retailers can protect at-risk customers, reduce fraud, and show they care about shopper safety.

Policy Recommendations:

- Require approval workflows for large gift card orders.

- Enforce a strict refund policy around gift card transactions.

Staff Training:

- Conduct monthly phishing simulation exercises.

- Post signs reminding customers and employees that you never request gift cards for payments.

POS Enhancements:

- Set transaction alerts for large gift card purchases.

- Cap gift card value or volume per transaction.

Conclusion

Gift card scams thrive on urgency, trust, and secrecy. By staying alert, educating others, and reporting fraudulent behavior, we can reduce the impact of these schemes. Protecting yourself, your loved ones, and your business starts with knowing the warning signs and acting quickly.

If you found this guide to be helpful, share it with your coworkers, friends, or family. Educating others about gift card scams can make a huge difference. Together, we can build a stronger line of defense against fraud.

Schedule a consultation with FTx Identity today and experience a demo to see how our advanced fraud prevention tools can enhance your security. Don’t wait – secure your business now!