Forget physical driver’s licenses. The future of age verification is already in most people’s pockets.

We’re not talking about flimsy ID cards anymore. Digital IDs, also known as electronic IDs or mobile driver’s licenses, are revolutionizing age verification. These secure, encrypted versions of your customer’s identity documents live on their smartphone, readily available for businesses to verify with ease.

Many states already offer mobile IDs, and their acceptance is rapidly growing. Businesses in these states can leverage this secure technology to streamline age verification.

Uncertain about accepting mobile IDs? Not sure if you can legally accept digital ID cards?

Our comprehensive guide dives deep into the mobile ID trend, providing clear guidance on next steps and legal requirements for businesses. Don’t get left behind – ensure you’re equipped to handle the future of age verification. Read our guide!

What Are Digital ID Cards?

Let’s unpack the concept of digital IDs and mobile driver’s licenses.

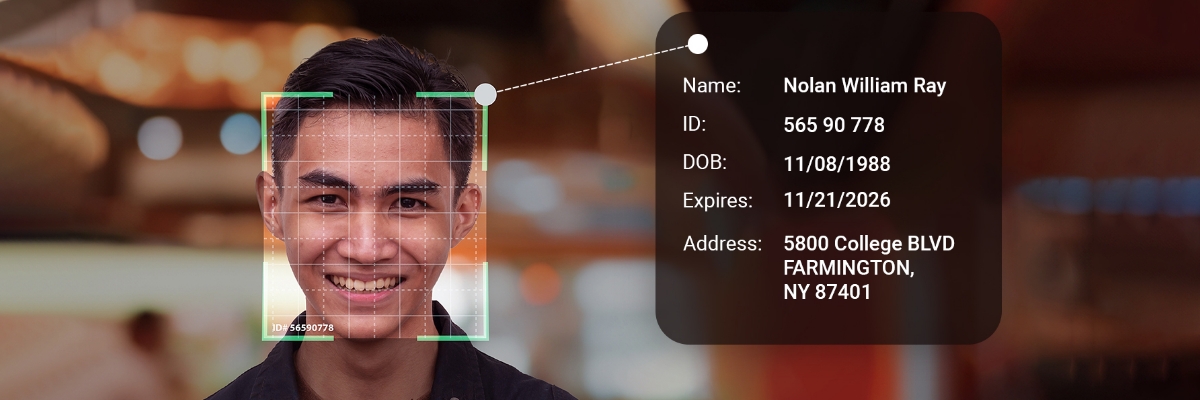

Imagine a secure version of your driver’s license stored safely on your smartphone. That’s the essence of a digital ID. You might hear them called mobile driver’s licenses (mDLs) or electronic IDs. Yet, no matter what they’re called, the idea is the same: It’s a digital document containing your verified identifying information, issued by a trusted source like your state’s Department of Motor Vehicles.

mDLs and digital ID cards typically include details like your name, photo, date of birth, and driving restrictions. They’re used for verifying age in-store or online or your identity when applying for a loan. They may even be an accepted form of ID by law enforcement.

One key benefit of mobile IDs: In some states, users can share only personal details (like their age and photo) to get their age verified. This provides an extra layer of privacy for individuals.

What States Accept Digital IDs?

According to the Information Technology and Innovation Foundation (ITIF), more than a dozen states—including Colorado, Louisiana, and California—have already rolled out digital ID programs. Even states without active programs are exploring the feasibility of launching their own, as the American Association of Motor Vehicle Administrators (AAMVA) shows.

In other words, digital ID cards are becoming increasingly common. Most businesses should start preparing to accept these digital forms of identification.

Different Types of Digital IDs

Think of digital ID verification as the new key to your store. It’s how you securely confirm who your customers are before they make a purchase. But not all digital IDs are the same. Understanding the different types helps you choose the right digital ID authentication method for your business—whether you’re verifying age for a cigar sale or securing an online transaction.

From government-backed credentials to corporate passes, here’s a breakdown of the most common forms of customer digital identification you might encounter:

1. Government-Issued Digital IDs

These are digital versions of driver’s licenses or passports. They’re issued by authorities and are the gold standard for digital ID authentication, especially for age-restricted retail compliance.

2. Corporate Digital IDs

Used for internal business access, these credentials let employees log into systems. For B2B retailers, they can streamline verified business purchases.

3. Financial Digital IDs

Created by banks during account opening, these are used for high-security actions like loan applications. They represent a pre-verified customer, reducing risk.

4. Third-Party Authorization

This method allows customers to use their existing logins from major platforms like Google, Apple, or Facebook to verify their identity on your site. It’s a form of digital ID authentication that prioritizes speed and convenience.

5. Decentralized Digital IDs

A newer model where users control their own credentials through blockchain technology, reducing reliance on central authorities among digital ID companies.

6. Workplace Digital IDs

Physical or digital badges used for building access and time tracking. These are part of internal security systems rather than customer-facing verification.

7. Healthcare Digital IDs

Used to securely access medical portals and health records. While not typically used for retail, they represent another form of electronic ID cards in specialized sectors.

How Does mDL Work?

Although programs vary by state, the idea is similar. These states typically develop their own mobile driver’s license app, or they allow you to connect with Apple Wallet or Google Wallet to store your ID.

Some examples include:

- myColorado – A state-issued digital ID card, which has been downloaded by more than one million Coloradoans. myColorado IDs can be used in dispensaries to purchase age-restricted products, in restaurants and bars, and in governmental agencies.

- Louisiana Wallet – One of the first mobile driver’s license programs, which is now accepted by the TSA.

- Arizona Mobile Driver’s License (mDL) – Available in Apple, Google, and Samsung wallets, along with the state’s digital ID app, Arizona mDLs can be used in place of a physical ID.

The Strategic Advantages of Adopting Digital ID Cards

For retailers, especially in regulated sectors, digital ID verification is no longer just a security measure—it’s a strategic business tool. Moving beyond physical IDs to customer digital identification streamlines operations, builds trust, and directly impacts your bottom line. Here’s how adopting electronic ID cards gives your business a competitive edge.

1. Convenience and Accessibility

Customers can verify their identity instantly using their smartphone, eliminating the need to carry physical documents. This mobile ID verification speeds up the checkout process, whether in-store or online, making access faster and more convenient.

2. Efficiency and Cost Reduction

Automating manual ID checks saves staff time and reduces administrative costs. This efficiency allows your team to focus on customer service instead of paperwork, directly boosting productivity.

3. Data Privacy and User Control

Reputable digital ID companies design systems where users control what information is shared. This builds customer trust, as only necessary data (like age confirmation) is verified without exposing full personal details.

4. Environmental Sustainability

By reducing reliance on physical plastic cards and paper documents, digital ID authentication supports eco-friendly business practices and appeals to environmentally conscious consumers.

5. Simplified Verification Procedure

A single, secure digital ID verification process can replace multiple manual checks. This simplification is crucial for compliance in age-restricted sales, reducing human error and ensuring consistent enforcement.

6. Easy Integration with Other Systems

Modern digital ID authentication solutions are built to connect seamlessly with your existing tools, such as your POS or e-commerce platform, creating a unified operational flow.

7. Real-Time Reporting

Gain instant insights into verification attempts and compliance rates. This actionable data helps you monitor trends, audit processes, and make informed business decisions on the spot.

8. Enhanced User Experience

A fast, seamless, and secure verification process removes friction for legitimate customers. This positive experience encourages repeat business and builds long-term loyalty.

How Do Digital IDs Work for Businesses?

Digital IDs are a relatively new technology. The process to accept a mobile driver’s license will vary based on your location and state requirements. Here’s a general breakdown:

1. Obtaining a Digital ID

Customers interested in using digital IDs will need to obtain them through their state’s Department of Motor Vehicles (DMV), assuming their state offers the program.

The DMV will likely have an application process to verify the user’s identity and issue the digital credential.

However, there might be the option to use a third-party verification app like FTx Identity (more info below). Check your state issuing authority’s guidelines to determine if you can accept third-party digital IDs.

2. Verification for Businesses

To accept digital IDs, your business might need to utilize a specific app provided by the issuing state or a third-party verification service. These apps will allow you to scan the customer’s digital ID and verify its authenticity with the issuing authority.

However, accepting a mobile ID may not require special technology. Verifying a Colorado Digital ID requires the business owner to only inspect the ID and/or scan the barcode (myColorado).

Can My Business Accept Digital IDs?

This is a crucial question for business owners considering accepting digital IDs. But here’s a short answer: It’s up to you.

If your state allows mobile driver’s licenses, you aren’t legally required to accept them. However, you might consider it if more of your customers begin to use them for age verification. Here are some things to think about:

1. Limited Adoption by States: As of today, digital ID programs are still in their early stages. Only a handful of US states have launched official programs, and acceptance is primarily within those issuing states. There’s no central system yet, so wider national recognition might take time. For example, it’s unlikely that you could use a California mobile ID if you were on vacation in Kansas.

2. Business Choice: The good news is that businesses are not mandated to accept digital IDs everywhere. You have the flexibility to decide if and when to integrate them into your verification process.

Here are some factors to consider:

- Benefits: Faster verification times, potential for increased security, and catering to a tech-savvy customer base.

- Wait-and-See Approach: You might choose to wait for wider adoption and clearer regulations before fully integrating digital IDs.

3. Future Outlook: While acceptance is limited today, digital IDs are a promising technology. As they become more prevalent, businesses that embrace them might gain a competitive edge in terms of efficiency and customer experience.

Digital ID Cards: Applications Across Industries

The shift to digital ID verification is transforming how businesses across sectors operate. From retail to healthcare, customer digital identification is streamlining processes, enhancing security, and creating smoother user experiences.

Here’s how different industries are leveraging this technology:

1. Government Services

Digital IDs enable citizens to access public services, submit tax forms, and verify benefits online securely. This digital ID authentication reduces in-person visits and paperwork while maintaining high security standards.

2. Retail and Age-Restricted Products Industries

For tobacco, alcohol, and CBD retailers, mobile ID verification provides instant age confirmation at checkout. Solutions like FTx Identity integrate directly with POS systems, ensuring compliance while maintaining a seamless customer experience.

3. Financial Sectors

Banks and fintech companies use digital ID authentication for account opening, loan applications, and high-value transactions. This helps meet Know Your Customer (KYC) requirements while reducing fraud through secure customer digital identification.

4. Healthcare Sectors

Patient portals and telemedicine platforms use digital IDs to verify identities before providing access to medical records or virtual consultations. This protects sensitive health information while improving accessibility.

5. Travel and Transportation

Airlines and border control agencies are adopting electronic ID cards for seamless check-ins and border crossings. This digital ID verification speeds up processes while maintaining security protocols.

6. Education and Employment

Universities and employers use digital credentials for student verification, remote exam proctoring, and employee onboarding. This streamlined approach reduces administrative overhead while preventing credential fraud.

Key Insight

While applications vary by industry, the core benefit remains the same—digital ID authentication creates secure, efficient experiences while reducing operational costs and compliance risks across all sectors.

Will Digital ID Cards Become Mainstream?

This is an important question, and to date, many individuals remain skeptical of storing documents on their phones. In Florida, for example, their state’s mobile ID program has been slow to grow (Governing), while Louisiana’s mobile ID program was much faster to grow (PR Newswire).

Therefore, many businesses are taking a wait-and-see approach. However, we recommend that businesses that cater to younger audiences and that sell age-restricted products should look to upgrade systems and prepare.

This audience is much more likely to go “wallet free” and store documents and payment options on their phones, according to the New York Times.

Are Third-Party Digital IDs OK to Accept?

Many companies specialize in digital identity verification and may offer digital IDs that businesses can accept as valid forms of identification. For example, FTx Identity offers online and in-store verification services.

Here’s how FTx Identity works:

Your customers can verify themselves in the FTx Identity app. Then, create a QR code to use for age checks at your business. This is essentially a reusable ID credential that provides a fast, convenient way for ID checks in your store.

Why Consider a Third-Party Digital ID System?

You might use a third-party provider for your business for a few reasons:

- Ease of Integration – State-created mobile driver’s license programs typically aren’t designed to integrate with your POS, ecommerce, or loyalty program tools.

- Omnichannel Selling – If your business sells in a brick-and-mortar and online, a third-party solution can help you bridge the gap, allowing you to verify customers online or in-store with one digital ID.

- Enhanced Security – Most state-issued mDVs are highly secure. However, many third-party systems may offer advanced encryption or security features.

- Across States – If you operate multiple locations across different states, a third-party digital ID system can help you provide continuity for your customers and staff and use a single system for verifying IDs.

Third-Party mDVs: Key Considerations

Although third-party digital ID systems provide benefits for businesses, it’s important to consider potential drawbacks of these systems:

State Laws and Regulations: States have different laws regarding acceptable forms of identification for age verification purposes. Some states explicitly allow the use of digital IDs, including mDLs, while others may not have updated their regulations to accommodate digital forms of identification.

Validity and Acceptance: Generally, for a third-party mDL to be accepted:

- It should meet the same criteria as a physical driver’s license issued by the state, including authentication, security, and reliability.

- Businesses should verify the authenticity of the mDL and ensure it complies with applicable state laws and regulations regarding age verification.

Risk and Liability: Businesses must consider the risk and liability associated with accepting digital IDs. They may need to verify the identity and age of the individual more rigorously compared to traditional forms of identification to mitigate potential risks of fraudulent IDs.

Industry Standards: Some industries, such as alcohol and tobacco sales, have stringent regulations for age verification. Businesses in these sectors may have specific guidelines or requirements regarding acceptable forms of ID, which may influence their decision to accept third-party mDLs.

Legal Precedents and Guidance: Depending on the state and industry, there may be legal precedents, guidelines from regulatory authorities, or industry best practices that dictate whether businesses can accept third-party mDLs for age verification.

Ultimately, if you sell age-restricted products online and in-store (like vape products or alcohol), a third-party system can help you design a better omnichannel customer experience.

Challenges and Risks in Implementing Digital ID Cards

While digital ID verification offers significant benefits, its implementation comes with real challenges that businesses must navigate. Understanding these risks is crucial for developing a secure and effective customer digital identification strategy that protects both your business and your customers.

1. Privacy and Data Protection Concerns

Storing sensitive customer information requires robust security measures. Businesses must ensure their chosen digital ID authentication solution complies with data protection regulations and gives users control over their personal data.

2. Cybersecurity Threats

Digital systems can be targets for hackers seeking personal information. Implementing strong encryption and multi-layered security protocols is essential for any digital ID verification system to prevent data breaches.

3. Digital Divide and Accessibility Issues

Not all customers have smartphones or reliable internet access. Relying solely on mobile ID verification could exclude certain customer segments, requiring businesses to maintain alternative verification methods.

4. Legal and Regulatory Barriers

Different regions have varying laws regarding digital identity acceptance. Businesses must ensure their digital ID authentication methods meet local compliance requirements, which can be particularly complex for cross-border operations.

5. Adoption and Trust Issues

Some customers may be hesitant to share personal information digitally. Building trust through transparent policies and demonstrating the security benefits of electronic ID cards is crucial for widespread acceptance.

Wrapping Up

The world of age verification is undergoing a digital transformation. Digital IDs and mobile driver’s licenses offer a glimpse into the future, promising a more secure and convenient way to verify customer identities. While widespread adoption is still on the horizon, businesses that stay informed and consider integrating digital IDs might gain a competitive edge.

Here are some resources to learn more:

- Your State’s Department of Motor Vehicles (DMV) website: Check if your state offers a digital ID program and how businesses can participate.

- Industry Associations: Retail and restaurant associations might provide resources and updates on digital ID adoption within your industry.

Building Customer Trust For Every Transaction.

Learn how our secure digital ID authentication protects your business and your customers’ data. Explore the

security features of FTx Identity.